Market Share

Compounding Chemotherapy Market Share Analysis

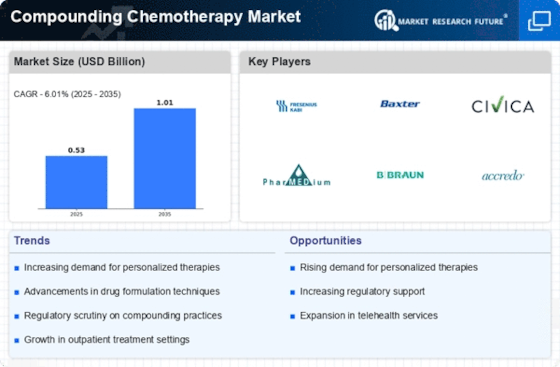

Understanding the Compounding Chemotherapy Market: Demand Drivers and Share Dynamics The compounding chemotherapy market, a vital segment within the broader oncology landscape, caters to the specific needs of patients requiring personalized medication solutions. This article explores the key drivers of demand and delves into the market share dynamics, offering valuable insights for stakeholders across the industry.

Demand Drivers:

Personalization: Compounding allows for customizing chemotherapy doses and formulations, catering to individual patient needs and addressing specific drug sensitivities or allergies. This personalized approach optimizes treatment efficacy and minimizes side effects. Dosage Flexibility: Compounding offers flexibility in dosage formats, such as oral suspensions, topical creams, or suppositories, making it suitable for patients who have difficulty swallowing pills or have specific administration needs. Drug Shortages: In cases of drug shortages, compounding plays a crucial role in ensuring uninterrupted patient care by providing alternative formulations or custom-compounded medications. Emerging Therapies: The development of new and innovative cancer therapies often requires specialized compounding techniques to prepare these medications for safe and effective administration. Regulatory Landscape: Regulatory changes within the pharmaceutical industry are driving demand for compounding, as some manufacturers may discontinue certain medications or change formulations, making compounded alternatives essential. Market Share Dynamics:

Regional Landscape: North America dominates the global compounding chemotherapy market, primarily driven by its well-established healthcare infrastructure, high cancer rates, and increasing adoption of personalized medicine approaches. End-Use Segment: Hospitals and clinics hold the largest share of the market due to their high volume of patients requiring chemotherapy treatment. However, demand from home care settings and long-term care facilities is expected to grow due to aging populations and the rising preference for home-based healthcare. Competitive Landscape: The market is characterized by a mix of large pharmaceutical companies, specialized compounding pharmacies, and independent pharmacies offering compounding services. Each segment plays a distinct role in meeting the diverse needs of patients and healthcare providers. Challenges and Opportunities:

Regulatory Compliance: Compounding pharmacies face stringent regulations and ongoing scrutiny from regulatory bodies. Ensuring compliance with evolving regulations is crucial for maintaining market access and patient safety. Cost and Reimbursement: Compounded medications are often more expensive than commercially available options. Obtaining adequate insurance coverage and navigating complex reimbursement processes can be challenging for both patients and healthcare providers. Quality Control: Maintaining consistent and high-quality standards in compounding is critical to ensure patient safety and medication effectiveness. Implementing robust quality control measures and continuous improvement initiatives is essential. Future Outlook:

The compounding chemotherapy market is expected to witness substantial growth in the coming years, driven by factors such as:

Rising Cancer Rates: The increasing global incidence of cancer will fuel the demand for personalized and effective treatment options, including compounded chemotherapy. Technological Advancements: Advancements in compounding technology and automation are expected to improve efficiency, reduce costs, and enhance the quality of compounded medications. Growing Awareness: Increased awareness among healthcare professionals and patients about the benefits of personalized medicine and compounding is expected to further drive market demand.

Leave a Comment