North America : Market Leader in Compliance Services

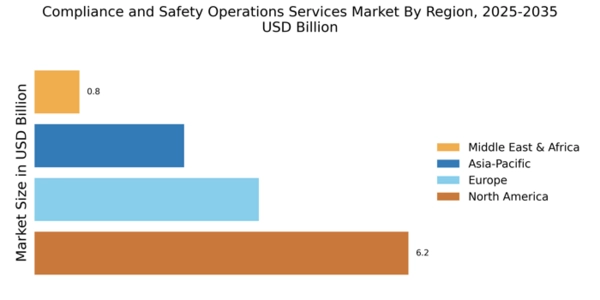

North America leads the Compliance and Safety Operations Services Market, holding a significant share of 6.25B in 2024. The region's growth is driven by stringent regulatory frameworks, increasing safety standards, and a rising demand for compliance solutions across various industries. The focus on workplace safety and environmental regulations further fuels market expansion, making it a critical area for investment and innovation.

The competitive landscape in North America is robust, featuring key players such as UL LLC, Bureau Veritas, and Intertek Group. The U.S. stands out as the largest market, supported by a strong regulatory environment and a high level of awareness regarding compliance. Companies are increasingly adopting advanced technologies to enhance service delivery, ensuring they meet the evolving needs of clients in various sectors.

Europe : Emerging Compliance Hub

Europe's Compliance and Safety Operations Services Market is valued at 3.75B, reflecting a growing emphasis on regulatory compliance across member states. The region benefits from comprehensive regulations such as REACH and the General Data Protection Regulation (GDPR), which drive demand for compliance services. The increasing focus on sustainability and corporate responsibility further propels market growth, as organizations seek to align with stringent European standards.

Leading countries in this market include Germany, France, and the UK, where major players like TÜV Rheinland and SGS operate. The competitive landscape is characterized by a mix of established firms and emerging players, all striving to innovate and provide comprehensive compliance solutions. The presence of a well-regulated environment encourages investment in compliance services, ensuring that businesses can navigate complex regulatory landscapes effectively.

Asia-Pacific : Rapidly Growing Compliance Market

The Asia-Pacific region, with a market size of 2.5B, is witnessing rapid growth in Compliance and Safety Operations Services. This surge is driven by increasing industrialization, urbanization, and a growing awareness of safety regulations among businesses. Governments are implementing stricter compliance measures, which are essential for attracting foreign investment and ensuring public safety, thus enhancing market demand.

Countries like China, India, and Japan are at the forefront of this growth, with a competitive landscape featuring both local and international players. Companies such as DNV GL and Applus+ are expanding their operations to meet the rising demand for compliance services. The region's diverse industries, including manufacturing and technology, are increasingly prioritizing compliance, creating significant opportunities for service providers.

Middle East and Africa : Emerging Compliance Landscape

The Middle East and Africa region, with a market size of 0.75B, is gradually emerging in the Compliance and Safety Operations Services Market. The growth is primarily driven by increasing regulatory frameworks aimed at enhancing safety standards across various sectors, including oil and gas, construction, and manufacturing. Governments are recognizing the importance of compliance in attracting foreign investment and ensuring public safety, leading to a rise in demand for compliance services.

Key countries in this region include the UAE and South Africa, where the presence of international players like Lloyd's Register and SAI Global is notable. The competitive landscape is evolving, with local firms also entering the market to provide tailored compliance solutions. As industries grow and regulations tighten, the demand for compliance services is expected to increase significantly, presenting opportunities for both established and new entrants.