Competent Cells Size

Competent Cells Market Growth Projections and Opportunities

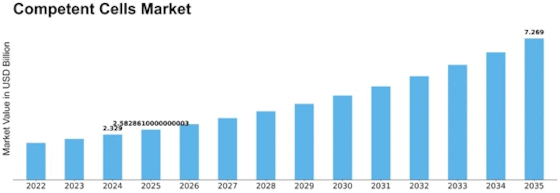

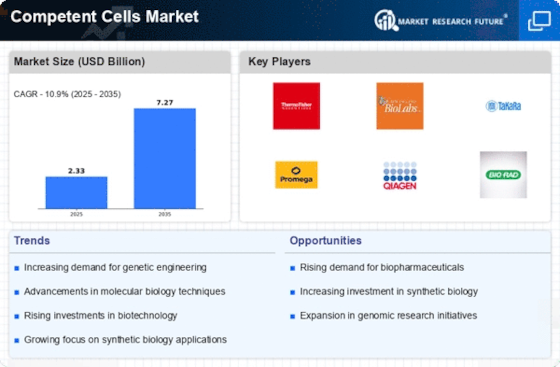

The Market size of the competent cells is expected to reach $4.8 billion by 2032 at a CAGR of 10.9% during the forecast period. The Competent Cells Market operates in a dynamic landscape that has been influenced by various factors that contribute to its growth and development. For example, they play an important role in molecular biology and genetic engineering by changing foreign DNA into bacterial cells and changing them into competent cells. However, it should be noted that research and development (R&D) efforts have played an important role in shaping the dynamics of the Competent Cells Market. These include biotech companies, academic institutions, and research organizations that are actively involved in developing and improving competent cell technologies for improved efficiency, transformation rates, and application across different areas of study. Ongoing developments with regard to strain selection, preparation methods, and specialized competent cells expand the usefulness of these types of cells, leading to a positive impact on market dynamics. Consequently, necessary drivers are resulting in evolution within this sector in terms of new, effective, competent cell solutions. Technological advancements also influence competent cell markets. Innovations in Cell Engineering techniques like Electro-competent & Chemical Competent cells have made it easier for people to use different transformation methods, which makes them more versatile than ever before. Regulatory considerations and quality standards also determine the market dynamics for competent cells. Stringent regulatory standards guarantee the safety and quality of products, while conformity to these standards is needed from competent cell manufacturers so as to maintain market credibility. Quality Assurance (QA) and compliance with Good Manufacturing Practices (GMP) are vital elements that drive demand from researchers as well as institutions. Companies operating within the market space negotiate their way strategically through regulatory landscapes, ensuring compliance while maintaining high product quality, thus influencing industry-wide dynamics. Another factor influencing market dynamics is competition between biotechnology firms competing against each other along with providers offering products/services related to such things as 'competent cells', which are usually required in labs as tools for genetic research procedures. Companies use various tactics ranging from product launches to partnerships and acquisitions in efforts to strengthen their market position and expand the range of available competent cell solutions. Competent cells also experience changes in their market dynamics due to economic factors. Research budgets and spending patterns are affected by economic conditions that ultimately influence what is affordable and accessible regarding competent cell products for academics, as well as industry researchers. Consumer preferences in this context refer to those of molecular biologists and institutions participating in genetic engineering. The increasing awareness of the significance of reliable, efficient, competent cells enables researchers to select products that meet their specific transformation requirements. Researchers' choice between highly efficient competent cells, versatile application potential, and ease of packaging is therefore aimed at fostering innovation within the sector.

Leave a Comment