Increase in Pet Ownership

The rise in pet ownership is a notable driver for the Companion Animal Healthcare Market. As more households adopt pets, the demand for veterinary services and products increases. Recent statistics indicate that approximately 67% of U.S. households own a pet, which translates to around 85 million families. This trend is mirrored in various regions, suggesting a growing recognition of pets as integral family members. Consequently, the Companion Animal Healthcare Market is experiencing heightened demand for preventive care, vaccinations, and routine check-ups. This increase in pet ownership not only drives revenue for veterinary practices but also encourages the development of innovative healthcare solutions tailored to the needs of diverse animal species. As pet owners become more invested in their pets' health, the market is likely to expand further.

Increase in Pet Insurance Adoption

The adoption of pet insurance is emerging as a significant driver for the Companion Animal Healthcare Market. As pet owners recognize the financial implications of veterinary care, the demand for insurance policies is on the rise. Recent data suggests that the pet insurance market has been growing at a rapid pace, with an increasing number of policies being sold each year. This trend is likely to continue as more pet owners seek to mitigate the costs associated with unexpected medical expenses. The availability of insurance plans encourages pet owners to pursue necessary treatments and preventive care without the burden of high out-of-pocket costs. Consequently, the Companion Animal Healthcare Market stands to benefit from this trend, as insured pets are more likely to receive comprehensive healthcare services, thereby driving overall market growth.

Growing Awareness of Animal Welfare

The increasing awareness of animal welfare is a critical driver for the Companion Animal Healthcare Market. As society becomes more conscious of the ethical treatment of animals, there is a corresponding rise in demand for high-quality healthcare services. Pet owners are now more informed about the importance of regular veterinary visits, vaccinations, and preventive care. This shift in mindset is reflected in the growing expenditure on pet healthcare, with owners willing to invest in premium services and products. Reports indicate that pet owners are increasingly seeking out holistic and alternative therapies, further diversifying the offerings within the Companion Animal Healthcare Market. This heightened focus on animal welfare not only benefits pets but also encourages veterinary professionals to enhance their services, leading to a more robust market.

Rise in E-commerce for Pet Products

The rise of e-commerce platforms is reshaping the Companion Animal Healthcare Market. With the convenience of online shopping, pet owners are increasingly turning to digital channels for purchasing healthcare products, medications, and supplies. This shift has been accelerated by the growing trend of pet owners seeking convenience and competitive pricing. E-commerce sales of pet products have seen substantial growth, with many companies expanding their online presence to cater to this demand. The ability to access a wide range of products and services from the comfort of home is appealing to consumers, leading to increased sales in the Companion Animal Healthcare Market. As e-commerce continues to evolve, it is likely that more innovative solutions will emerge, further enhancing the shopping experience for pet owners and contributing to market expansion.

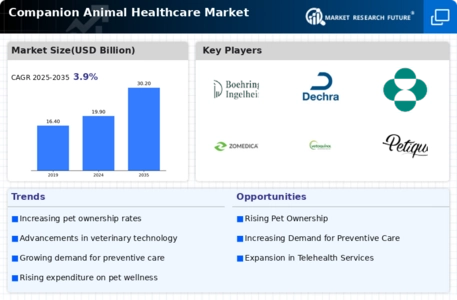

Advancements in Veterinary Technology

Technological advancements are significantly influencing the Companion Animal Healthcare Market. Innovations such as telemedicine, wearable health monitors, and advanced diagnostic tools are transforming how veterinary care is delivered. For instance, telemedicine allows pet owners to consult with veterinarians remotely, enhancing accessibility to healthcare services. The market for veterinary telehealth is projected to grow substantially, reflecting a shift towards more convenient care options. Additionally, the integration of artificial intelligence in diagnostics is improving the accuracy and speed of disease detection in companion animals. These technological developments not only enhance the quality of care but also streamline operations within veterinary practices, potentially leading to increased profitability. As technology continues to evolve, the Companion Animal Healthcare Market is expected to adapt, offering more sophisticated solutions to meet the needs of pet owners.

Leave a Comment