Urbanization Trends

Rapid urbanization is a significant driver of the Global Compact Construction Equipment Market Industry. As populations migrate to urban areas, the demand for housing, commercial spaces, and infrastructure rises. This urban expansion necessitates the use of compact construction equipment, which is ideal for navigating tight spaces and delivering efficient performance. The market is expected to grow at a CAGR of 4.2% from 2025 to 2035, reflecting the increasing reliance on compact machinery in densely populated areas. Urbanization not only fuels demand but also encourages innovation in compact equipment, enhancing productivity and sustainability in construction practices.

Market Growth Projections

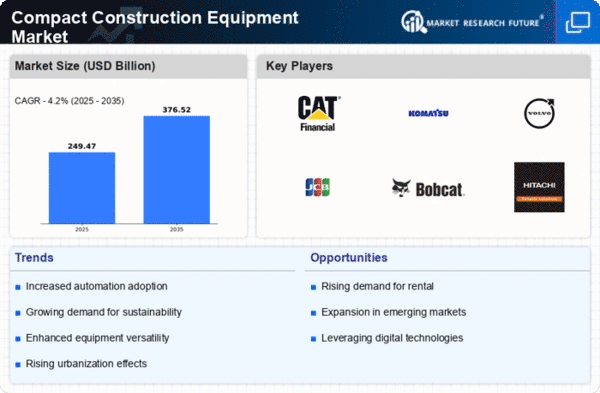

The Global Compact Construction Equipment Market Industry is projected to experience substantial growth in the coming years. With a market value of 239.4 USD Billion in 2024, it is anticipated to reach 376.5 USD Billion by 2035, reflecting a CAGR of 4.2% from 2025 to 2035. This growth trajectory suggests a robust demand for compact construction equipment, driven by factors such as infrastructure development, urbanization, and technological advancements. The increasing reliance on compact machinery in construction projects highlights its importance in meeting the evolving needs of the industry.

Technological Advancements

Technological advancements play a crucial role in shaping the Global Compact Construction Equipment Market Industry. Innovations such as telematics, automation, and electric-powered machinery are transforming the landscape of compact construction equipment. These technologies enhance operational efficiency, reduce emissions, and improve safety on job sites. As companies adopt these advancements, they are likely to see increased productivity and reduced operational costs. The integration of smart technologies is expected to attract investments, further propelling the market. By 2035, the market is projected to reach 376.5 USD Billion, indicating the potential impact of these technological trends on future growth.

Rising Demand for Rental Equipment

The Global Compact Construction Equipment Market Industry is witnessing a rising demand for rental equipment, driven by cost-effectiveness and flexibility. Many construction firms prefer renting compact machinery rather than purchasing it outright, as this approach allows them to manage costs more effectively and adapt to project-specific needs. The rental market is expanding, providing access to the latest equipment without the burden of ownership. This trend is particularly pronounced in urban areas where project timelines are often tight. As the rental market continues to grow, it is likely to contribute significantly to the overall expansion of the compact construction equipment sector.

Infrastructure Development Initiatives

The Global Compact Construction Equipment Market Industry is experiencing a surge due to various infrastructure development initiatives worldwide. Governments are investing heavily in infrastructure projects, including roads, bridges, and public transportation systems. For instance, in 2024, the market is projected to reach 239.4 USD Billion, driven by these investments. Such projects necessitate the use of compact construction equipment, which is favored for its efficiency and versatility in urban environments. As countries aim to enhance their infrastructure to support economic growth, the demand for compact construction equipment is likely to increase, indicating a robust growth trajectory.

Sustainability and Environmental Regulations

The Global Compact Construction Equipment Market Industry is increasingly influenced by sustainability and environmental regulations. Governments worldwide are implementing stricter regulations aimed at reducing carbon footprints and promoting eco-friendly practices in construction. Compact construction equipment, often designed with lower emissions and higher fuel efficiency, aligns well with these regulatory frameworks. As a result, construction companies are more inclined to invest in compact machinery that meets these standards. This shift towards sustainable practices not only enhances compliance but also appeals to environmentally conscious consumers, potentially driving market growth in the coming years.