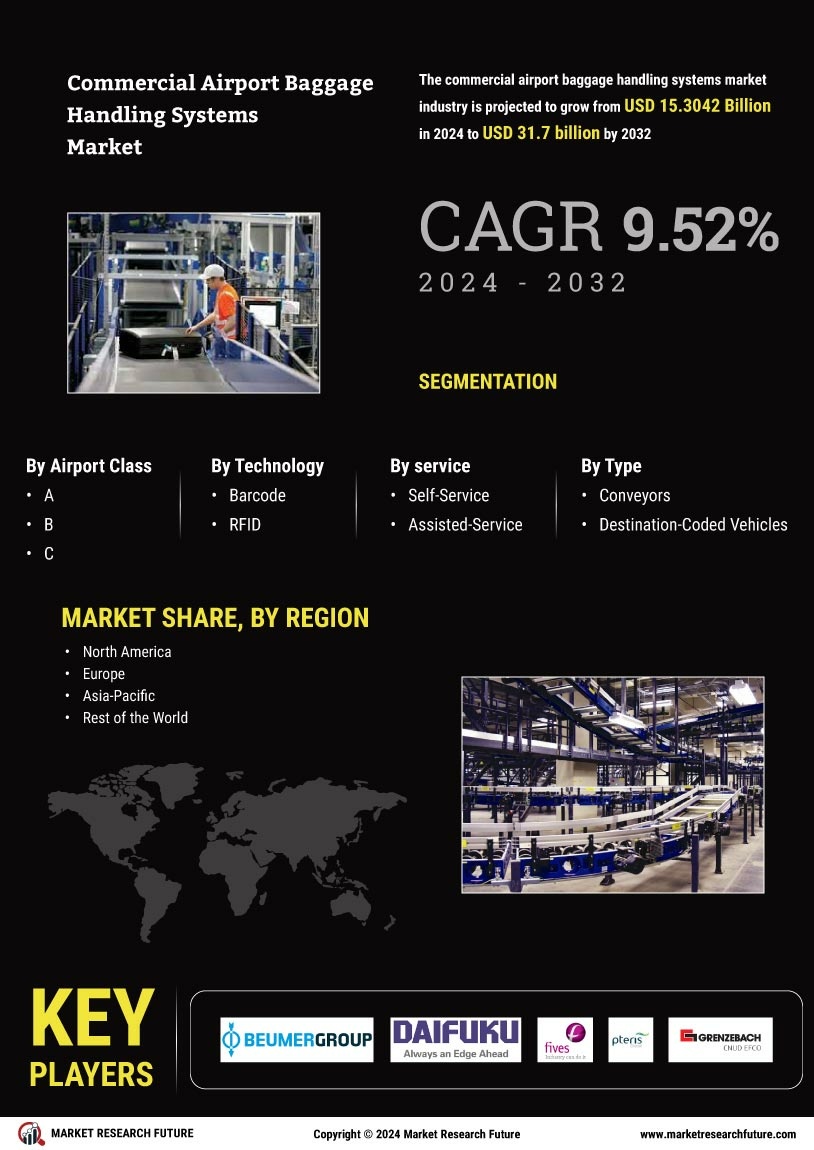

Market Growth Projections

The Global commercial airport baggage handling systems Industry is projected to experience substantial growth in the coming years. With a market value of 15.3 USD Billion in 2024, it is anticipated to reach 41.7 USD Billion by 2035, reflecting a compound annual growth rate of 9.53% from 2025 to 2035. This growth trajectory indicates a robust demand for innovative baggage handling solutions as airports adapt to increasing passenger traffic and evolving technological landscapes. The market dynamics suggest that stakeholders must remain agile and responsive to emerging trends to capitalize on the opportunities presented by this expanding industry.

Sustainability Initiatives

Sustainability initiatives are increasingly shaping the Global Commercial Airport Baggage Handling Systems Industry. Airports are under pressure to reduce their environmental footprint, prompting investments in eco-friendly baggage handling solutions. These initiatives may include energy-efficient systems and the use of sustainable materials in baggage handling equipment. As airports strive to achieve sustainability goals, the demand for innovative solutions that align with these objectives is likely to rise. This trend not only contributes to environmental conservation but also enhances the overall operational efficiency of baggage handling systems, positioning airports as responsible entities in the aviation sector.

Technological Advancements

Technological innovations play a pivotal role in shaping the Global Commercial Airport Baggage Handling Systems Industry. The integration of automation, artificial intelligence, and IoT technologies enhances operational efficiency and reduces human error. For instance, automated baggage handling systems can significantly decrease the time taken for baggage processing, thereby improving passenger satisfaction. Airports are increasingly investing in these technologies to streamline operations and manage the complexities of modern air travel. As the industry evolves, the adoption of smart baggage handling solutions is likely to become a standard practice, further driving market growth and ensuring that airports can meet the demands of an expanding passenger base.

Increasing Air Travel Demand

The Global Commercial Airport Baggage Handling Systems Industry is experiencing growth driven by the rising demand for air travel. As more passengers opt for air transportation, airports are compelled to enhance their baggage handling capabilities. In 2024, the market is valued at 15.3 USD Billion, reflecting the need for efficient systems to manage increased baggage volumes. This trend is projected to continue, with the market expected to reach 41.7 USD Billion by 2035. The compound annual growth rate of 9.53% from 2025 to 2035 indicates a robust expansion, necessitating advanced technologies and systems to accommodate the growing passenger traffic.

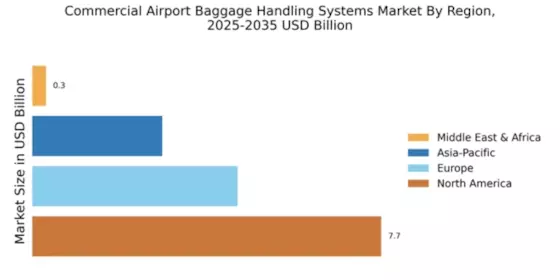

Expansion of Airport Infrastructure

The expansion of airport infrastructure is a crucial driver for the Global Commercial Airport Baggage Handling Systems Industry. As global air travel continues to grow, many airports are undergoing significant upgrades and expansions to accommodate increased passenger volumes. This includes the development of new terminals and the enhancement of existing facilities, which necessitates the installation of advanced baggage handling systems. The ongoing investments in airport infrastructure are expected to create substantial opportunities for market players, as airports seek to implement state-of-the-art systems that can efficiently manage the complexities of modern air travel.

Regulatory Compliance and Safety Standards

The Global Commercial Airport Baggage Handling Systems Industry is influenced by stringent regulatory compliance and safety standards imposed by aviation authorities. Airports must adhere to these regulations to ensure the safety and security of passengers and their belongings. Compliance with international standards necessitates the implementation of advanced baggage handling systems that can efficiently manage security checks and minimize risks. This focus on safety not only enhances operational reliability but also fosters passenger trust in air travel. As regulations evolve, airports are likely to invest in upgrading their baggage handling systems to meet these requirements, thereby driving market growth.