Focus on Cybersecurity

In an era where cyber threats are escalating, the Command and Control Systems Market is placing a heightened emphasis on cybersecurity measures. Organizations are investing in secure communication channels and robust encryption protocols to safeguard sensitive data and maintain operational integrity. The increasing frequency of cyberattacks on critical infrastructure has prompted governments and private entities to prioritize cybersecurity in their command and control systems. This focus is reflected in market data, which indicates that cybersecurity solutions within this sector are expected to witness a growth rate of approximately 15% annually. As a result, the demand for command and control systems that incorporate advanced cybersecurity features is likely to rise, ensuring resilience against potential threats.

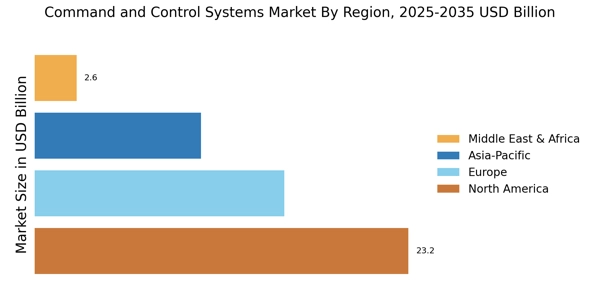

Increased Defense Spending

The Command and Control Systems Market is benefiting from increased defense spending across various nations. Governments are recognizing the importance of modernizing their military capabilities, which includes investing in advanced command and control systems. This trend is particularly pronounced in regions facing geopolitical tensions, where enhanced situational awareness and rapid response capabilities are paramount. Recent data indicates that defense budgets are expected to rise by an average of 5% annually, with a significant portion allocated to upgrading command and control infrastructure. This influx of funding is likely to drive innovation and development within the market, as manufacturers strive to meet the evolving needs of defense agencies.

Real-time Data Utilization

The ability to utilize real-time data is becoming a cornerstone of the Command and Control Systems Market. Organizations are increasingly relying on instantaneous data feeds to make informed decisions during critical operations. This trend is particularly evident in military applications, where timely intelligence can significantly impact mission success. The market is witnessing a surge in demand for systems that can process and analyze vast amounts of data in real-time, enabling operators to respond swiftly to evolving situations. According to recent estimates, the segment focusing on real-time data processing is projected to grow at a rate of 12% over the next five years. This growth underscores the necessity for command and control systems that can effectively harness real-time information to enhance situational awareness.

Growing Demand for Interoperability

The Command and Control Systems Market is witnessing a growing demand for interoperability among various systems and platforms. As military and emergency response operations become increasingly complex, the ability to integrate different command and control systems is essential for effective coordination. This trend is driven by the need for seamless communication between various agencies and units, which can significantly enhance operational efficiency. Market analysis suggests that the interoperability segment is expected to grow at a rate of 11% over the next few years, as organizations seek solutions that facilitate collaboration across diverse platforms. This demand for interoperability is likely to shape the future of command and control systems, pushing manufacturers to develop more adaptable and integrative solutions.

Integration of Advanced Technologies

The Command and Control Systems Market is experiencing a notable shift towards the integration of advanced technologies such as artificial intelligence, machine learning, and big data analytics. These technologies enhance decision-making processes by providing real-time insights and predictive analytics. For instance, the incorporation of AI algorithms allows for improved threat detection and response times, which is crucial in military and emergency management applications. As organizations increasingly recognize the value of these technologies, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This trend indicates a robust demand for sophisticated command and control systems that can leverage these advancements to optimize operational efficiency.