Top Industry Leaders in the Command Control Systems Market

Strategies Adopted:

Technology Innovation: Key players invest in research and development to develop advanced command and control systems incorporating artificial intelligence, machine learning, and data analytics capabilities, enhancing situational awareness, decision-making, and mission effectiveness.

Strategic Partnerships: Forming strategic partnerships and alliances with government agencies, defense contractors, and technology providers enables companies to access complementary capabilities, expand market reach, and strengthen competitive position.

Market Diversification: Diversifying product portfolios to address emerging market segments, such as unmanned systems, cyber defense, and space-based assets, allows companies to capitalize on evolving customer requirements and market trends.

Focus on Cybersecurity: With the increasing threat of cyber attacks, companies prioritize cybersecurity measures to safeguard command and control systems from unauthorized access, data breaches, and malicious activities, ensuring mission-critical operations' integrity and reliability.

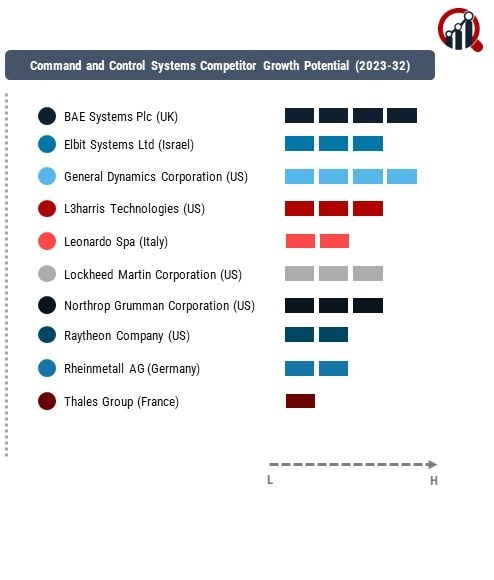

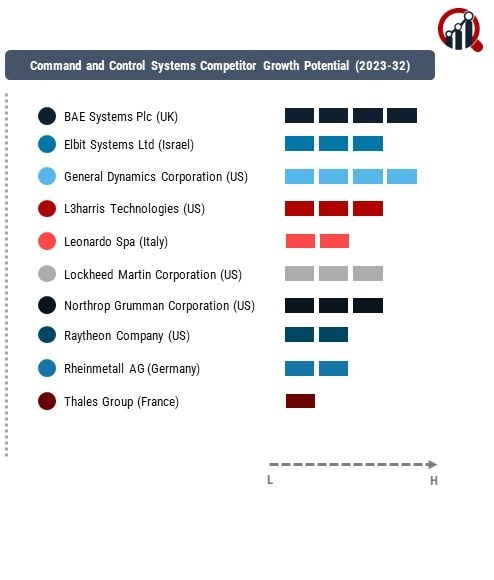

Key Companies in the Command and Control Systems market include

BAE Systems Plc (UK)

Elbit Systems Ltd (Israel)

General Dynamics Corporation (US)

L3harris Technologies (US)

Leonardo Spa (Italy)

Lockheed Martin Corporation (US)

Northrop Grumman Corporation (US)

Raytheon Company (US)

Rheinmetall AG (Germany)

Thales Group (France)

Factors for Market Share Analysis:

Technological Superiority: Companies offering command and control systems with advanced features, performance capabilities, and interoperability gain market share by meeting customer demands for state-of-the-art solutions that enhance military operational effectiveness and efficiency.

Customer Relationships: Established players with strong relationships with defense ministries, armed forces, and government agencies secure market share by leveraging trust, reputation, and past performance in delivering reliable and mission-critical command and control solutions.

Global Presence: Companies with a global presence, extensive sales networks, and regional offices maintain market share by effectively serving diverse customer bases, addressing regional requirements, and adapting products to local needs and regulations.

After-Sales Support: Providing comprehensive after-sales support, including maintenance, training, and system upgrades, enhances companies' competitiveness by ensuring customer satisfaction, system reliability, and long-term partnership engagement.

New and Emerging Companies:

CACI International Inc. (US)

Kratos Defense & Security Solutions, Inc. (US)

QinetiQ Group plc (UK)

Rheinmetall AG (Germany)

Leidos Holdings, Inc. (US)

Inmarsat plc (UK)

Cubic Corporation (US)

Booz Allen Hamilton Holding Corporation (US)

Mercury Systems, Inc. (US)

Persistent Systems, LLC (US)

Industry News:

Contract Awards: News of contract awards, project wins, and government procurements highlight companies' success in securing business opportunities, driving revenue growth, and expanding market presence.

Technology Demonstrations: Demonstrations of new command and control technologies, system upgrades, and product launches showcase companies' innovation capabilities and commitment to advancing military command and control capabilities.

Mergers and Acquisitions: Mergers, acquisitions, and strategic partnerships reshape the competitive landscape by consolidating market players, expanding product portfolios, and enhancing market competitiveness.

International Collaborations: Collaborations between companies, defense ministries, and international organizations on joint development projects and interoperability initiatives demonstrate efforts to promote international cooperation and standardization in command and control systems.

Current Company Investment Trends:

Research and Development: Investments in research and development focus on developing next-generation command and control technologies, including network-centric warfare capabilities, secure communications, and multi-domain integration, to address evolving threat environments and operational requirements.

Cybersecurity Solutions: Increasing investments in cybersecurity solutions, including encryption, authentication, and intrusion detection systems, aim to enhance command and control systems' resilience against cyber threats and ensure data protection and system integrity.

Global Expansion: Investments in global expansion initiatives, such as establishing regional offices, forming partnerships, and participating in international defense exhibitions, facilitate market penetration, customer engagement, and business development efforts.

Training and Support Services: Investments in training and support services, including simulation systems, training exercises, and technical assistance programs, aim to enhance customer readiness, system proficiency, and operational effectiveness, fostering long-term customer relationships and loyalty.

Command and Control Systems Industry Developments

For Instance, September 2022

Honeywell's Solutions Command and Control Centre (GSCCC) will open in Gurugram and offer remote monitoring and technical support to the company's Oil & Gas (O&G) sector.

For Instance, September2022

For Larsen & Toubro (L&T), an Indian multinational engaged in EPC projects, Mindtree, a provider of technology services and a leader in digital transformation, announced the design and implementation of a digital command and control solution.