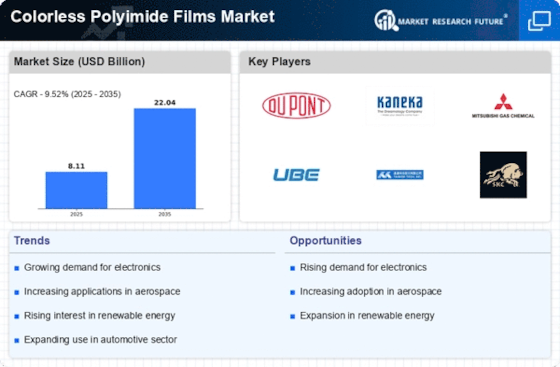

Rising Demand in Electronics

The Colorless Polyimide Films Market experiences a notable surge in demand driven by the rapid advancements in the electronics sector. As devices become increasingly compact and sophisticated, the need for materials that offer superior thermal stability and electrical insulation becomes paramount. Colorless polyimide films, known for their excellent dielectric properties, are increasingly utilized in flexible printed circuits and displays. Recent data indicates that the electronics segment accounts for a substantial share of the market, with projections suggesting a compound annual growth rate of over 10% in the coming years. This trend underscores the critical role that colorless polyimide films play in enabling the miniaturization and performance enhancement of electronic devices.

Growth in Aerospace Applications

The Colorless Polyimide Films Market is significantly influenced by the expanding applications in the aerospace sector. The unique properties of colorless polyimide films, such as high thermal resistance and lightweight characteristics, make them ideal for use in aircraft components and insulation systems. As the aerospace industry continues to innovate, the demand for advanced materials that can withstand extreme conditions is likely to increase. Recent estimates suggest that the aerospace segment could contribute to nearly 15% of the overall market share by 2026. This growth is indicative of the increasing reliance on colorless polyimide films to enhance the performance and safety of aerospace technologies.

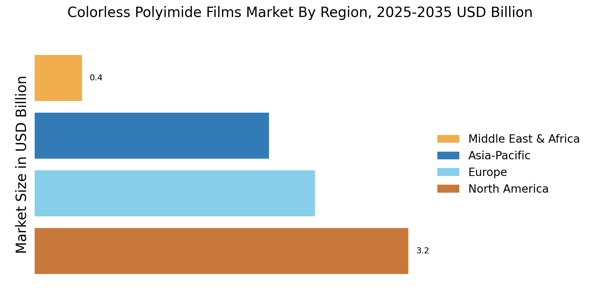

Emerging Markets and Economic Growth

The Colorless Polyimide Films Market is experiencing growth driven by emerging markets and their economic development. Countries in Asia-Pacific and Latin America are witnessing rapid industrialization, leading to increased demand for advanced materials in various sectors, including electronics, automotive, and aerospace. The expansion of manufacturing capabilities in these regions is likely to create new opportunities for colorless polyimide films. Market forecasts suggest that the Asia-Pacific region alone could account for over 40% of the total market share by 2027, reflecting the significant potential for growth in these emerging economies. This trend indicates a promising future for colorless polyimide films as they become integral to the evolving industrial landscape.

Increasing Focus on Renewable Energy

The Colorless Polyimide Films Market is poised to benefit from the growing emphasis on renewable energy technologies. As the world shifts towards sustainable energy solutions, the demand for materials that can withstand high temperatures and harsh environments is rising. Colorless polyimide films are increasingly utilized in solar panels and wind turbine components due to their durability and thermal stability. Recent market analyses indicate that the renewable energy sector could account for a significant portion of the colorless polyimide films market, with expectations of a growth rate of around 8% annually. This trend highlights the potential for colorless polyimide films to play a crucial role in supporting the transition to sustainable energy.

Advancements in Manufacturing Processes

The Colorless Polyimide Films Market benefits from ongoing advancements in manufacturing processes that enhance the quality and efficiency of film production. Innovations such as roll-to-roll processing and improved coating techniques have led to the development of high-performance films with superior optical clarity and mechanical strength. These advancements not only reduce production costs but also expand the potential applications of colorless polyimide films across various industries. Market data suggests that the efficiency gains from these manufacturing innovations could lead to a reduction in production time by up to 20%, thereby increasing the overall competitiveness of colorless polyimide films in the market.