Sustainability Initiatives

The Collapsible Tube Packaging Market is increasingly influenced by sustainability initiatives. As consumers become more environmentally conscious, there is a growing demand for packaging solutions that minimize waste and utilize recyclable materials. Companies are responding by adopting eco-friendly practices, such as using biodegradable materials and reducing the carbon footprint of their production processes. This shift not only aligns with consumer preferences but also meets regulatory requirements aimed at reducing plastic waste. In fact, the market for sustainable packaging is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 5% in the coming years. This trend is likely to drive innovation within the Collapsible Tube Packaging Market, as manufacturers seek to develop products that are both functional and environmentally responsible.

Technological Advancements

Technological advancements are playing a crucial role in shaping the Collapsible Tube Packaging Market. Innovations in materials science and manufacturing processes are enabling the production of more durable and versatile tubes. For instance, the introduction of multi-layered tubes enhances barrier properties, ensuring product integrity and extending shelf life. Additionally, automation in production lines is streamlining operations, reducing costs, and increasing efficiency. Recent reports suggest that the adoption of smart packaging technologies, such as QR codes and NFC tags, is on the rise, allowing brands to engage consumers through interactive experiences. This integration of technology not only improves functionality but also adds value to the consumer experience, making it a key driver in the Collapsible Tube Packaging Market.

Health and Safety Regulations

Health and safety regulations are becoming increasingly stringent, influencing the Collapsible Tube Packaging Market. Regulatory bodies are imposing guidelines to ensure that packaging materials are safe for consumer use, particularly in sectors such as food and pharmaceuticals. Compliance with these regulations is essential for manufacturers, as non-compliance can lead to significant financial penalties and damage to brand reputation. The market is witnessing a shift towards the use of non-toxic, safe materials that meet these regulatory standards. Recent data indicates that companies investing in compliance and safety measures are likely to see a 15% increase in market share. As a result, adherence to health and safety regulations is not only a legal requirement but also a strategic driver for growth within the Collapsible Tube Packaging Market.

Customization and Personalization

Customization and personalization are becoming pivotal drivers in the Collapsible Tube Packaging Market. Brands are increasingly recognizing the importance of tailored packaging solutions that resonate with their target audience. This trend is particularly evident in sectors such as cosmetics and pharmaceuticals, where unique packaging can enhance brand identity and consumer engagement. The market is witnessing a rise in demand for tubes that can be customized in terms of size, color, and design, allowing brands to differentiate themselves in a competitive landscape. Recent data indicates that personalized packaging can lead to a 20% increase in customer satisfaction, thereby fostering brand loyalty. As a result, manufacturers in the Collapsible Tube Packaging Market are investing in advanced printing technologies and design capabilities to meet these evolving consumer expectations.

Rising Demand in Emerging Markets

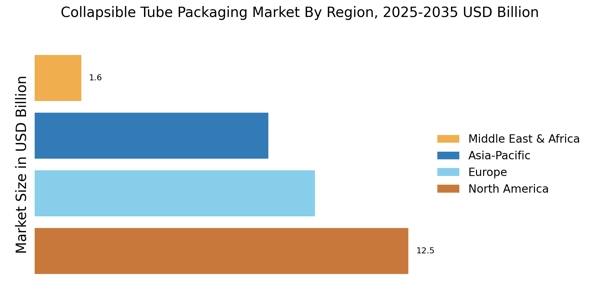

The rising demand in emerging markets is significantly impacting the Collapsible Tube Packaging Market. As economies in regions such as Asia and Latin America continue to grow, there is an increasing need for effective packaging solutions across various sectors, including food, cosmetics, and pharmaceuticals. This demand is driven by a burgeoning middle class that seeks quality products and is willing to invest in premium packaging. Market analysis indicates that the Asia-Pacific region alone is expected to witness a substantial increase in packaging consumption, with projections estimating a growth rate of over 6% annually. Consequently, manufacturers are focusing on expanding their presence in these markets, adapting their products to meet local preferences and regulatory standards, thereby fueling growth in the Collapsible Tube Packaging Market.