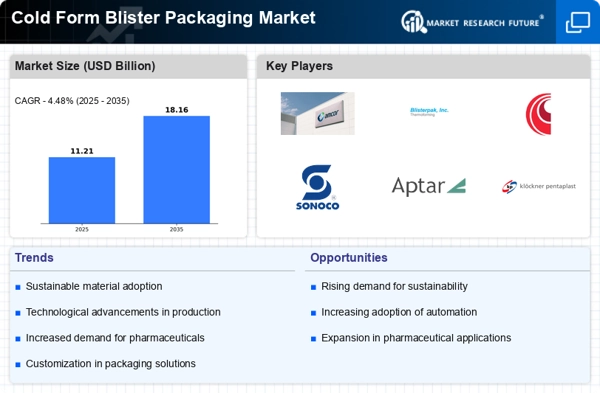

Rising Demand for Pharmaceuticals

The Cold Form Blister Packaging Market is witnessing a surge in demand driven by the pharmaceutical sector. As the global population ages and the prevalence of chronic diseases increases, the need for effective and safe medication delivery systems is paramount. Cold form blister packaging offers superior protection and tamper-evidence, making it an ideal choice for pharmaceutical products. Recent market analysis suggests that the pharmaceutical packaging segment is projected to grow at a rate of 7% annually, further propelling the demand for cold form blister solutions. This growth is indicative of the industry's response to the increasing complexity of drug formulations and the necessity for reliable packaging that ensures product integrity.

Consumer Preferences for Convenience

Consumer preferences are shifting towards convenience, significantly impacting the Cold Form Blister Packaging Market. As lifestyles become busier, there is a growing demand for packaging that offers ease of use and portability. Cold form blister packaging provides an efficient solution, allowing for single-dose packaging that enhances user experience. This trend is particularly evident in over-the-counter medications and dietary supplements, where consumers favor products that are easy to carry and use. Market Research Future indicates that the convenience packaging segment is expected to grow by 5% annually, reflecting the changing dynamics of consumer behavior. Companies that adapt to these preferences are likely to gain a competitive edge in the Cold Form Blister Packaging Market.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are critical drivers in the Cold Form Blister Packaging Market. As governments and health organizations impose stricter regulations on packaging materials and processes, manufacturers are compelled to adhere to these guidelines to ensure product safety and efficacy. Compliance with regulations such as the FDA's guidelines for pharmaceutical packaging is essential for market access. This necessity for adherence not only enhances consumer trust but also mitigates risks associated with product recalls and safety issues. The market for compliant packaging solutions is projected to grow, as companies invest in technologies and processes that meet these stringent requirements. This focus on regulatory compliance is likely to shape the future landscape of the Cold Form Blister Packaging Market.

Sustainability Initiatives in Cold Form Blister Packaging

Sustainability initiatives are becoming increasingly prominent within the Cold Form Blister Packaging Market. As environmental concerns rise, manufacturers are seeking eco-friendly materials and processes to reduce their carbon footprint. The shift towards biodegradable and recyclable materials is gaining traction, with many companies committing to sustainable practices. This trend is not only driven by regulatory pressures but also by consumer demand for greener products. Recent studies indicate that the market for sustainable packaging is expected to reach USD 500 billion by 2027, reflecting a significant opportunity for the Cold Form Blister Packaging Market to align with these initiatives. By adopting sustainable practices, companies can enhance their brand image and appeal to environmentally conscious consumers.

Technological Advancements in Cold Form Blister Packaging

The Cold Form Blister Packaging Market is experiencing a notable transformation due to rapid technological advancements. Innovations in materials and manufacturing processes are enhancing the efficiency and effectiveness of packaging solutions. For instance, the introduction of high-barrier films is significantly improving product protection against moisture and light, which is crucial for pharmaceuticals. Furthermore, automation in production lines is streamlining operations, reducing costs, and increasing output. According to recent data, the market for advanced packaging technologies is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years. This growth is indicative of the industry's shift towards more sophisticated packaging solutions that meet the evolving needs of manufacturers and consumers alike.