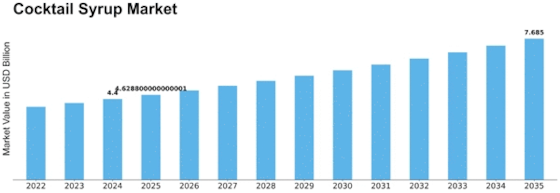

Cocktail Syrup Size

Cocktail Syrup Market Growth Projections and Opportunities

The cocktail syrup market is influenced by several key market factors that shape its growth and trajectory. One significant factor driving this market is the increasing popularity of craft cocktails and mixology. As consumers become more interested in unique and creative cocktails, there is a growing demand for high-quality cocktail syrups that can enhance the flavor and complexity of drinks. This trend is driving manufacturers to develop innovative syrup flavors and formulations to cater to the evolving tastes of consumers.

Another important market factor is the influence of social media and digital platforms. Social media platforms allow bartenders, mixologists, and enthusiasts to share cocktail recipes and techniques, increasing consumer awareness and interest in cocktail syrups. Additionally, the rise of online shopping has made it easier for consumers to purchase cocktail syrups from anywhere, further fueling the growth of this market.

Additionally, the trend toward healthier and natural ingredients is also impacting the cocktail syrup market. Consumers are becoming more conscious of what they consume and are seeking out products made with natural and organic ingredients. This trend is driving manufacturers to develop cocktail syrups made with natural sweeteners and flavors, such as agave syrup, honey, and fruit extracts, to meet consumer demand for healthier options.

On the supply side, the cocktail syrup market is influenced by factors such as production and competition. Manufacturers are constantly developing new and innovative syrup flavors to meet consumer demand and differentiate themselves in the market. This constant innovation is driving competition in the market, leading to a wider range of cocktail syrup flavors available to consumers.

Moreover, the regulatory environment plays a crucial role in shaping the cocktail syrup market. Regulations around the manufacturing, labeling, and marketing of cocktail syrups vary by country, impacting the availability and sale of these products. Stringent regulations can limit market growth, while favorable regulations can create opportunities for market expansion.

Leave a Comment