North America : Market Leader in Cloud Solutions

North America continues to lead the Cloud System Repair and Optimization Market, holding a significant share of 6.25 in 2024. The region's growth is driven by increasing cloud adoption across various sectors, including finance, healthcare, and technology. Regulatory support for data protection and cybersecurity further fuels demand, as organizations seek to optimize their cloud systems while ensuring compliance with stringent regulations.

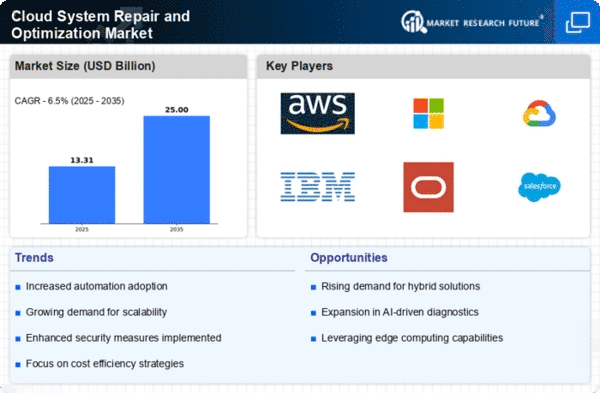

The competitive landscape is robust, with key players like Amazon Web Services, Microsoft, and Google Cloud dominating the market. These companies are continuously innovating to enhance their service offerings, focusing on AI-driven optimization and repair solutions. The presence of established tech giants and a strong startup ecosystem positions North America as a hub for cloud innovation, attracting investments and talent alike.

Europe : Emerging Cloud Market Dynamics

Europe's Cloud System Repair and Optimization Market is on the rise, with a market size of 3.75 in 2024. The region benefits from a strong regulatory framework that promotes data privacy and security, driving demand for cloud optimization services. Initiatives like the General Data Protection Regulation (GDPR) encourage businesses to invest in cloud solutions that enhance compliance and operational efficiency, thus propelling market growth.

Leading countries such as Germany, the UK, and France are at the forefront of this growth, with a competitive landscape featuring major players like IBM and Oracle. The presence of innovative startups and established firms fosters a dynamic environment for cloud services. As organizations increasingly migrate to the cloud, the demand for repair and optimization solutions is expected to surge, further solidifying Europe's position in the global market.

Asia-Pacific : Rapidly Growing Cloud Sector

The Asia-Pacific region is witnessing rapid growth in the Cloud System Repair and Optimization Market, with a market size of 2.5 in 2024. Factors such as increasing digital transformation initiatives, rising internet penetration, and a growing number of SMEs are driving demand for cloud solutions. Governments in countries like India and China are also promoting cloud adoption through favorable policies and investments in digital infrastructure, which act as catalysts for market expansion.

Key players in this region include Alibaba Cloud and VMware, which are focusing on enhancing their service offerings to cater to the diverse needs of businesses. The competitive landscape is evolving, with both established companies and startups vying for market share. As organizations increasingly rely on cloud technologies, the need for effective repair and optimization solutions will continue to grow, positioning Asia-Pacific as a significant player in the global market.

Middle East and Africa : Emerging Cloud Opportunities

The Middle East and Africa region is gradually emerging in the Cloud System Repair and Optimization Market, with a market size of 0.75 in 2024. The growth is driven by increasing investments in digital transformation and cloud infrastructure, as businesses seek to enhance operational efficiency. Governments are also recognizing the importance of cloud technology, leading to initiatives that promote its adoption across various sectors, including finance and healthcare.

Countries like the UAE and South Africa are leading the charge, with a growing number of local and international players entering the market. The competitive landscape is characterized by a mix of established firms and new entrants, all aiming to capture the growing demand for cloud services. As the region continues to develop its digital capabilities, the need for cloud repair and optimization solutions is expected to rise significantly, presenting ample opportunities for growth.