Emergence of 5G Technology

The Cloud Network Infrastructure Market is poised for transformation with the emergence of 5G technology. The rollout of 5G networks is expected to enhance connectivity and enable faster data transmission, which is crucial for cloud services. This technological advancement opens new avenues for cloud applications, particularly in sectors such as IoT and real-time data processing. Analysts predict that the adoption of 5G will lead to a significant increase in cloud service consumption, potentially doubling the demand for cloud infrastructure within the next few years. As businesses seek to leverage the benefits of 5G, the Cloud Network Infrastructure Market is likely to witness substantial growth driven by the need for infrastructure that can support high-speed, low-latency applications.

Increased Focus on Data Analytics

The Cloud Network Infrastructure Market is experiencing a heightened focus on data analytics capabilities. Organizations are increasingly recognizing the value of data-driven decision-making, prompting investments in cloud infrastructure that can support advanced analytics tools. The integration of analytics into cloud solutions allows businesses to derive actionable insights from vast amounts of data. Recent reports indicate that the analytics segment within the cloud market is expected to grow by over 25% in the coming years. This growth reflects a broader trend where companies leverage cloud-based analytics to enhance operational efficiency and customer engagement. As a result, the demand for sophisticated cloud network infrastructure that can handle complex data processing tasks is on the rise, further propelling the Cloud Network Infrastructure Market.

Shift Towards Remote Work Solutions

The Cloud Network Infrastructure Market is significantly influenced by the shift towards remote work solutions. As organizations embrace flexible work arrangements, the demand for robust cloud infrastructure has intensified. This shift necessitates reliable and secure network solutions that can support remote access to applications and data. Recent statistics suggest that nearly 70% of companies are investing in cloud technologies to facilitate remote work. This trend not only enhances productivity but also fosters collaboration among distributed teams. Consequently, the Cloud Network Infrastructure Market is witnessing an influx of investments aimed at developing solutions that cater to the unique challenges posed by remote work environments, thereby driving market growth.

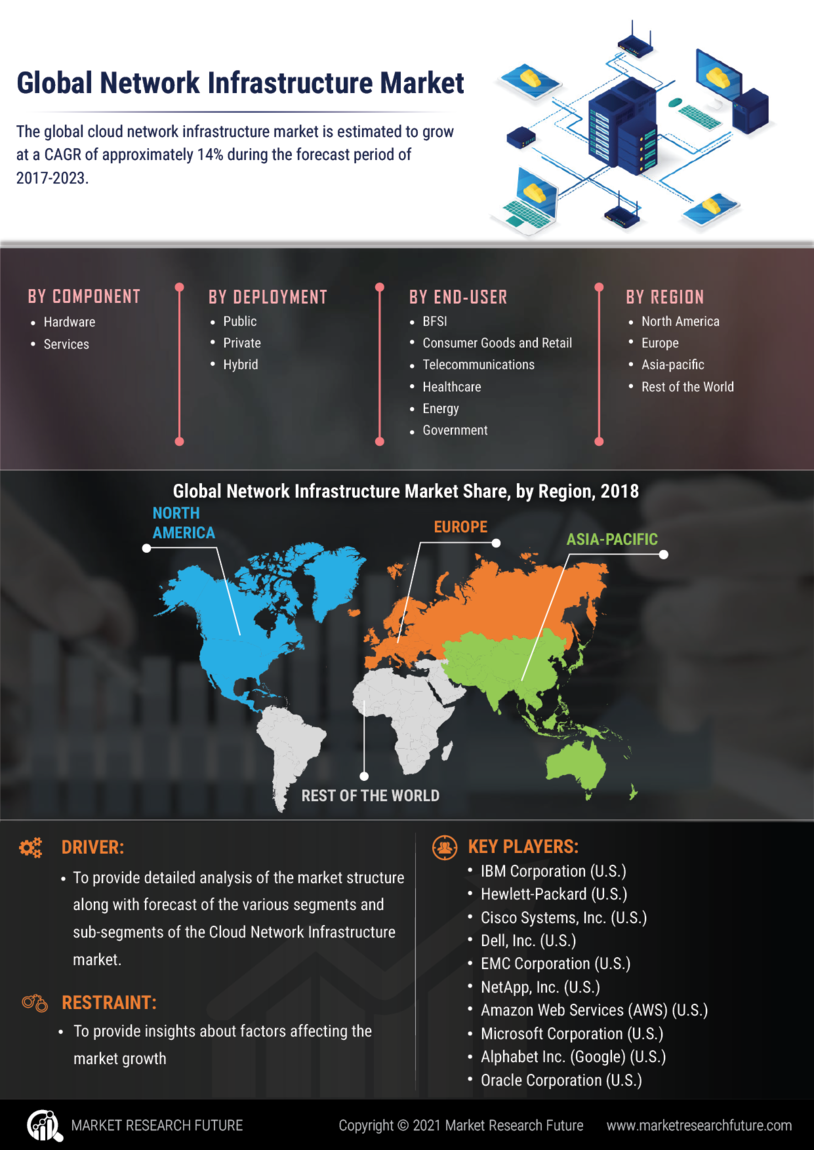

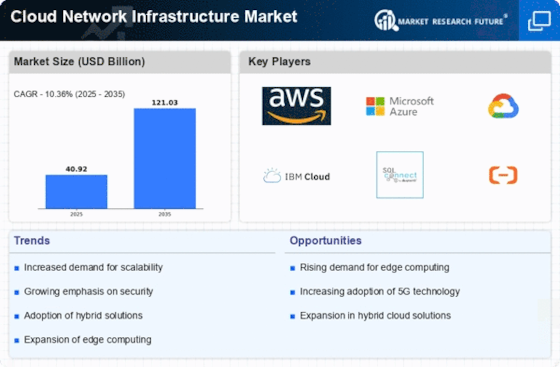

Rising Demand for Scalable Solutions

The Cloud Network Infrastructure Market experiences a notable surge in demand for scalable solutions. Organizations increasingly seek to expand their IT capabilities without incurring substantial costs. This trend is driven by the need for flexibility in resource allocation, allowing businesses to adapt to changing market conditions. According to recent data, the market for cloud infrastructure is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This growth indicates a strong preference for scalable cloud solutions that can accommodate varying workloads and user demands. As companies transition to cloud-based models, the ability to scale resources efficiently becomes a critical factor in their operational strategies, thereby propelling the Cloud Network Infrastructure Market forward.

Growing Importance of Compliance and Regulatory Standards

The Cloud Network Infrastructure Market is increasingly shaped by the growing importance of compliance and regulatory standards. Organizations are under pressure to adhere to various regulations concerning data privacy and security, which necessitates the implementation of robust cloud infrastructure. Compliance with standards such as GDPR and HIPAA requires cloud solutions that offer enhanced security features and data management capabilities. Recent findings indicate that nearly 60% of enterprises prioritize compliance when selecting cloud service providers. This trend underscores the necessity for cloud network infrastructure that not only meets regulatory requirements but also instills confidence among customers. As compliance becomes a critical factor in cloud adoption, the Cloud Network Infrastructure Market is likely to see a surge in demand for compliant cloud solutions.