Need for Real-Time Data Access

In the current digital landscape, the need for real-time data access is becoming increasingly critical for organizations. The Cloud Integration Software Market is responding to this demand by providing solutions that enable businesses to access and analyze data in real-time, regardless of its source. This capability is essential for decision-making processes, as timely insights can lead to competitive advantages. As organizations generate vast amounts of data, the ability to integrate and analyze this information swiftly is paramount. Market data suggests that companies leveraging real-time data integration can improve their operational efficiency by up to 30%. Consequently, the Cloud Integration Software Market is witnessing a growing emphasis on tools that facilitate real-time data integration, thereby enhancing the overall agility and responsiveness of businesses.

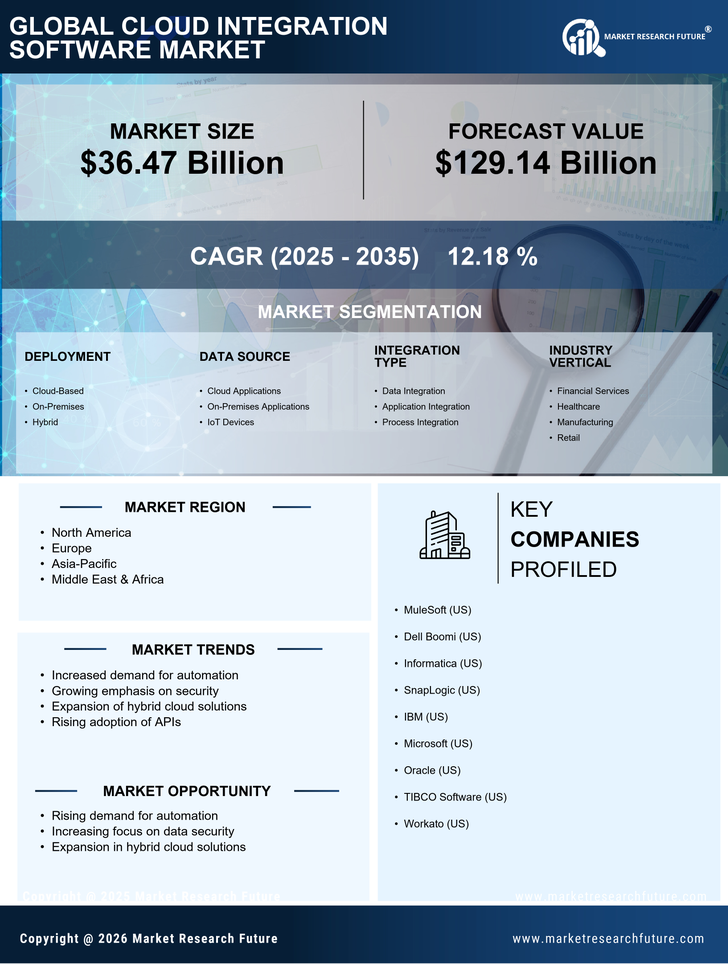

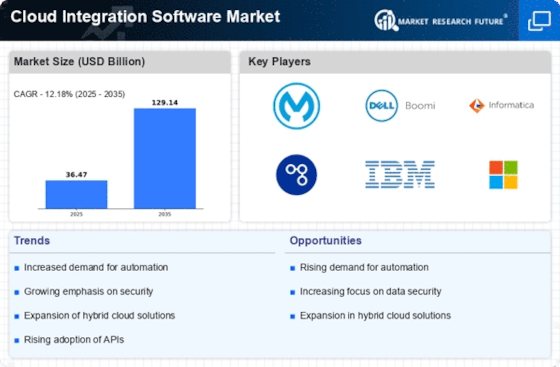

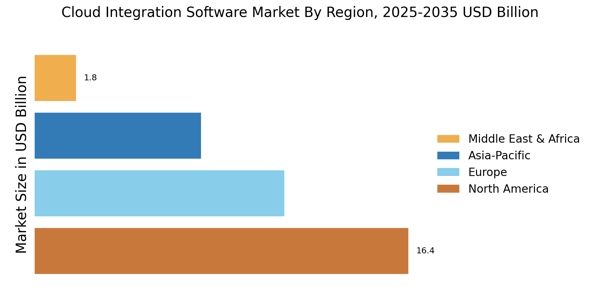

Rising Adoption of Cloud Services

The Cloud Integration Software Market is experiencing a notable surge in the adoption of cloud services across various sectors. Organizations are increasingly migrating their operations to the cloud to enhance flexibility, scalability, and cost-effectiveness. According to recent data, the cloud services market is projected to reach a valuation of over 500 billion dollars by 2025, indicating a robust growth trajectory. This trend is driving the demand for cloud integration software, as businesses seek to seamlessly connect their cloud applications and data sources. The ability to integrate disparate systems is becoming essential for organizations aiming to optimize their workflows and improve operational efficiency. As more companies recognize the benefits of cloud solutions, the Cloud Integration Software Market is likely to expand significantly, providing opportunities for vendors to innovate and offer tailored solutions.

Emergence of IoT and Connected Devices

The proliferation of Internet of Things (IoT) devices is significantly influencing the Cloud Integration Software Market. As more devices become interconnected, the need for effective integration solutions is paramount. Organizations are increasingly relying on cloud integration software to manage the vast amounts of data generated by these devices. This trend is expected to drive substantial growth in the market, with estimates indicating that the number of connected devices could exceed 75 billion by 2025. The ability to integrate data from various IoT sources into centralized systems is crucial for businesses aiming to harness the full potential of their IoT investments. As such, the Cloud Integration Software Market is likely to see a surge in demand for solutions that facilitate seamless integration of IoT data, enabling organizations to derive actionable insights and improve operational efficiencies.

Growing Focus on Digital Transformation

Digital transformation initiatives are reshaping the business landscape, and the Cloud Integration Software Market is at the forefront of this evolution. Organizations are increasingly recognizing the importance of integrating their digital tools and platforms to enhance customer experiences and streamline operations. Market data indicates that companies investing in digital transformation are likely to see a return on investment of up to 300% within three years. This growing focus on digital transformation is driving the demand for cloud integration software, as businesses seek to create cohesive ecosystems that facilitate collaboration and innovation. As organizations embark on their digital journeys, the Cloud Integration Software Market is poised for growth, providing essential tools that enable seamless integration of various digital assets.

Increased Regulatory Compliance Requirements

The Cloud Integration Software Market is also being shaped by the increasing regulatory compliance requirements across various sectors. Organizations are facing heightened scrutiny regarding data privacy and security, necessitating robust integration solutions that ensure compliance with regulations such as GDPR and HIPAA. As businesses strive to meet these compliance standards, the demand for cloud integration software that offers secure and compliant data handling is on the rise. Market data suggests that companies investing in compliance-focused integration solutions can mitigate risks and avoid potential penalties. Consequently, the Cloud Integration Software Market is likely to see a growing emphasis on solutions that not only facilitate integration but also ensure adherence to regulatory requirements, thereby enhancing trust and credibility in the eyes of consumers.