Regulatory Compliance Pressures

The Cloud Infrastructure Entitlement Management CIEM Market is significantly influenced by the pressures of regulatory compliance. As governments and regulatory bodies introduce stringent data protection laws, organizations are compelled to adopt CIEM solutions to ensure adherence to these regulations. The increasing complexity of compliance requirements, such as GDPR and CCPA, necessitates the implementation of effective entitlement management practices. Companies that fail to comply may face severe penalties, which further drives the demand for CIEM solutions. The market is expected to witness a substantial increase in adoption rates as organizations prioritize compliance to mitigate risks associated with non-compliance.

Increasing Complexity of IT Environments

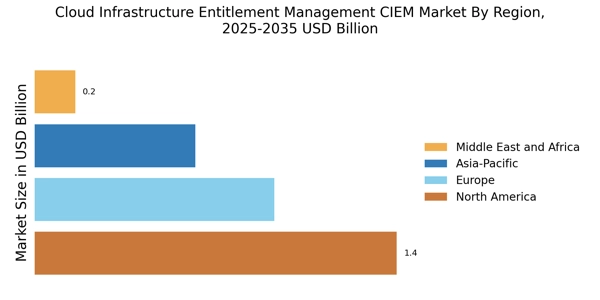

The Cloud Infrastructure Entitlement Management CIEM Market is significantly impacted by the increasing complexity of IT environments. As organizations adopt multi-cloud strategies and hybrid infrastructures, managing user access across diverse platforms becomes increasingly challenging. This complexity necessitates the implementation of robust CIEM solutions that can provide centralized visibility and control over entitlements. The demand for such solutions is expected to rise as organizations seek to streamline their access management processes and reduce the risk of unauthorized access. Analysts suggest that the CIEM market will continue to expand as businesses prioritize the need for comprehensive entitlement management in their increasingly intricate IT landscapes.

Integration of Advanced Analytics and AI

The Cloud Infrastructure Entitlement Management CIEM Market is being shaped by the integration of advanced analytics and artificial intelligence technologies. These innovations enable organizations to gain deeper insights into user behavior and access patterns, facilitating more informed decision-making regarding entitlement management. By leveraging AI-driven analytics, companies can proactively identify potential security risks and optimize their access control strategies. This trend is likely to enhance the overall effectiveness of CIEM solutions, making them more appealing to organizations seeking to bolster their security postures. The market is anticipated to grow as businesses recognize the value of integrating AI capabilities into their entitlement management frameworks.

Rising Demand for Enhanced Security Solutions

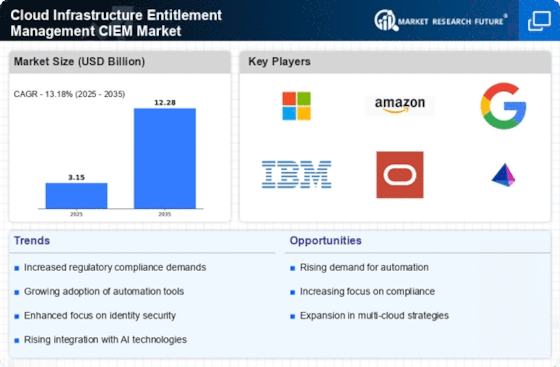

The Cloud Infrastructure Entitlement Management CIEM Market is experiencing a notable surge in demand for enhanced security solutions. Organizations are increasingly recognizing the importance of safeguarding sensitive data and managing user access effectively. This heightened focus on security is driven by the growing number of cyber threats and data breaches, which have prompted businesses to invest in robust CIEM solutions. According to recent estimates, the CIEM market is projected to grow at a compound annual growth rate of over 20% in the coming years. This growth is indicative of the urgent need for organizations to implement comprehensive entitlement management strategies that ensure compliance with regulatory standards and protect against unauthorized access.

Shift Towards Remote Work and Digital Transformation

The Cloud Infrastructure Entitlement Management CIEM Market is witnessing a transformative shift due to the rise of remote work and digital transformation initiatives. As organizations transition to cloud-based infrastructures, the need for effective entitlement management becomes paramount. Remote work environments introduce unique challenges related to user access and data security, prompting businesses to seek CIEM solutions that can provide granular control over permissions. This trend is expected to propel the CIEM market forward, with analysts predicting a significant uptick in investments in entitlement management technologies as companies strive to secure their digital assets in an increasingly decentralized work environment.