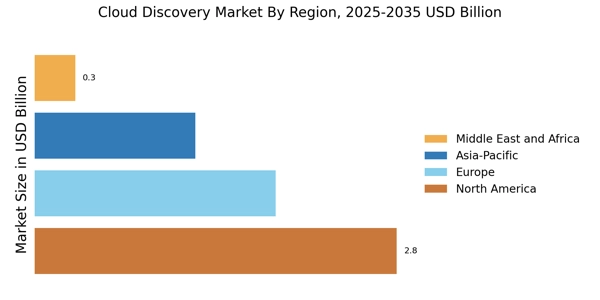

North America : Cloud Innovation Leader

North America is the largest market for Cloud Discovery Market, holding approximately 45% of the global share. The region's growth is driven by rapid digital transformation, increasing cloud adoption, and stringent data compliance regulations. The U.S. government has implemented various initiatives to promote cloud technologies, further fueling demand. The second largest market is Europe, accounting for around 30% of the market share, driven by similar trends in digitalization and regulatory frameworks.

The competitive landscape in North America is robust, with key players like Microsoft, Amazon, and Google leading the charge. These companies are continuously innovating to enhance their cloud offerings, ensuring compliance with regulations such as the Federal Risk and Authorization Management Program (FedRAMP). The presence of major tech hubs and a skilled workforce further solidify North America's position as a leader in the Cloud Discovery Market.

Europe : Regulatory-Driven Growth

Europe is witnessing significant growth in the Cloud Discovery Market, holding approximately 30% of the global share. The region's expansion is largely driven by stringent data protection regulations such as the General Data Protection Regulation (GDPR), which mandates organizations to adopt cloud solutions that ensure data security and compliance. Additionally, the increasing demand for digital services and cloud-based solutions is propelling market growth, making Europe the second largest market after North America.

Leading countries in Europe include Germany, the UK, and France, which are at the forefront of cloud adoption. The competitive landscape features major players like IBM and Oracle, who are investing heavily in cloud technologies to meet regulatory requirements. The presence of various startups and established firms in the region fosters innovation, making Europe a dynamic player in the Cloud Discovery Market.

Asia-Pacific : Rapid Adoption and Growth

Asia-Pacific is rapidly emerging as a significant player in the Cloud Discovery Market, holding approximately 20% of the global share. The region's growth is fueled by increasing internet penetration, a surge in mobile device usage, and a growing emphasis on digital transformation across various sectors. Countries like China and India are leading this growth, supported by government initiatives aimed at enhancing digital infrastructure and cloud adoption, making Asia-Pacific the third largest market globally.

The competitive landscape in Asia-Pacific is diverse, with local and international players vying for market share. Key players such as Alibaba Cloud and Tencent are making substantial investments in cloud technologies, while global giants like Microsoft and Amazon are also expanding their presence. The region's unique challenges, including regulatory variations and data sovereignty issues, are shaping the competitive dynamics in the Cloud Discovery Market.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) region is gradually emerging in the Cloud Discovery Market, holding approximately 5% of the global share. The growth is driven by increasing investments in digital infrastructure and a rising demand for cloud services across various sectors, including finance and healthcare. Governments in the region are actively promoting cloud adoption through initiatives aimed at enhancing digital economies, making MEA a region with significant growth potential in the coming years.

Leading countries in the MEA region include the UAE and South Africa, which are spearheading cloud initiatives. The competitive landscape is characterized by a mix of local and international players, with companies like Microsoft and Amazon establishing data centers to cater to regional demands. The presence of various startups is also fostering innovation, contributing to the overall growth of the Cloud Discovery Market in the region.