Market Trends

Key Emerging Trends in the Cloud Business Email Market

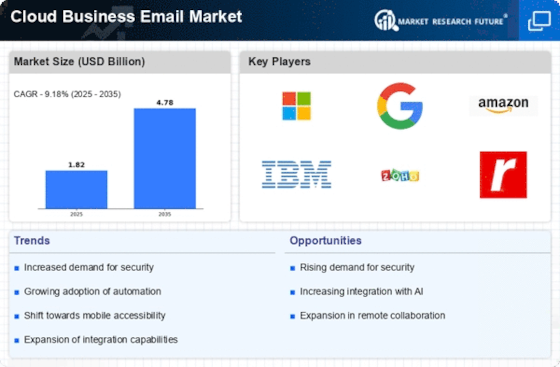

The Cloud Business Email market has grown due to global companies' growing adoption of cloud-based solutions. Organizations are seeing the benefits of switching to cloud-based email systems. Cloud arrangements' flexibility, agility, and cost-effectiveness drove this change. Businesses are thrilled to streamline their communication, and cloud business email services provide a reliable solution.

One notable industry trend is the rise of cloud business email platforms with integrated collaborative effort tools. Companies are seeking comprehensive communication solutions beyond email as remote work becomes increasingly popular. Cloud email providers respond by integrating continuous informing, video conferencing, and document sharing. Current work situations demand regular coordinated effort and communication for efficiency, therefore this pattern fits.

Security concerns have also driven Cloud Business Email industry trends. Businesses are prioritizing email security as digital threats evolve. Cloud email providers are responding with encryption, threat intelligence, and multidimensional validation. Improved security features should provide organizations confidence that their sensitive data and correspondences are safe in the cloud.

The market is also experiencing a surge in AI and ML in cloud corporate email systems. These advances are improving email sorting, automating repetitive tasks, and identifying security threats. Human intelligence-powered features improve email frameworks by reducing manual mediation, improving accuracy, and providing valuable customer behavior data.

Cost-effectiveness drives cloud corporate email adoption. Organizations are seeing the financial benefits of switching from capital-intensive, on-premise email to membership-based cloud services. Cloud email providers provide flexible pricing, allowing organizations to grow their email services to meet their needs. All else being equal, cloud business email is cost-effective for corporations since it assures fair remuneration for assets used.

Leave a Comment