Top Industry Leaders in the Closed Cell Foam Market

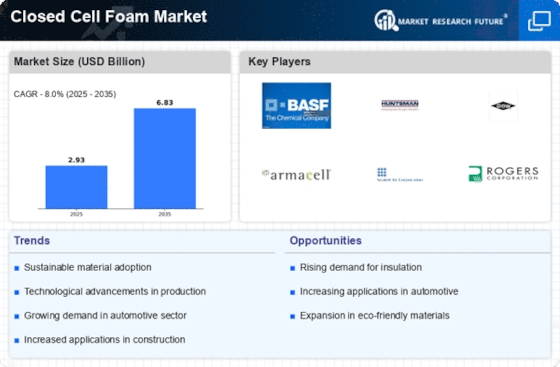

The global closed cell foam market is poised for steady growth at a CAGR of 8.00% over the next decade, driven by increasing demand across diverse end-use industries. This report delves into the competitive landscape, analyzing key strategies, market share influencers, industry news, and recent developments in the past six months.

Competitive Landscape: A Multifaceted Arena

The closed cell foam market is characterized by a diverse range of players, from established global giants to regional specialists. Key players include:

-

3A Composites: A leading manufacturer of high-performance closed-cell foams for various applications, including automotive and aerospace. -

Armacell International SA: A global leader in elastomeric foam insulation materials, offering a wide range of products for building and construction. -

The Dow Chemical Company: A major player in the polyolefin foams segment, known for its innovative technologies and global reach. -

Saint-Gobain: A French multinational conglomerate with a strong presence in the closed-cell foam market through its Isover brand. -

L'Oreal: A major player in the cosmetics and personal care industry, utilizing closed-cell foams in packaging and product formulations.

Factors Influencing Market Share:

Several factors influence market share dynamics in the closed-cell foam market:

-

Product type: Different closed-cell foam types, such as polyolefin, polyurethane, and polyethylene, cater to specific applications and price points, impacting market share distribution. -

End-use industry: The construction industry remains the largest consumer, followed by automotive, packaging, and furniture. Growth in these sectors directly impacts market share of relevant players. -

Regional trends: Asia-Pacific is the fastest-growing region due to rapid urbanization and infrastructure development. Europe and North America hold significant market shares, but face slower growth due to market maturity. -

Government regulations: Stringent regulations on environmental safety and fire retardancy can create entry barriers for smaller players and favor established companies with compliant products. -

Technological advancements: Development of new foam formulations with enhanced properties can shift market share towards innovative players.

Key companies in the Closed Cell Foam Market include

- 3A Composites

- Armacell

- Regal Plastics

Industry News

-

August 2023: Dow Chemical announces the launch of its new ENVISION™ closed-cell foam, made from recycled post-consumer plastic waste, targeting the packaging and furniture industries. -

September 2023: Armacell International SA acquires US-based insulation manufacturer J.F. Taylor, expanding its presence in the North American market. -

October 2023: The International Organization for Standardization (ISO) releases new fire safety standards for closed-cell foams in building and construction applications, impacting product development and market dynamics. -

November 2023: The European Commission proposes a ban on single-use plastics, potentially boosting demand for sustainable closed-cell foam packaging solutions. -

December 2023: The Chinese government announces increased investments in infrastructure development, including green buildings, which is expected to drive demand for closed-cell foam insulation materials.