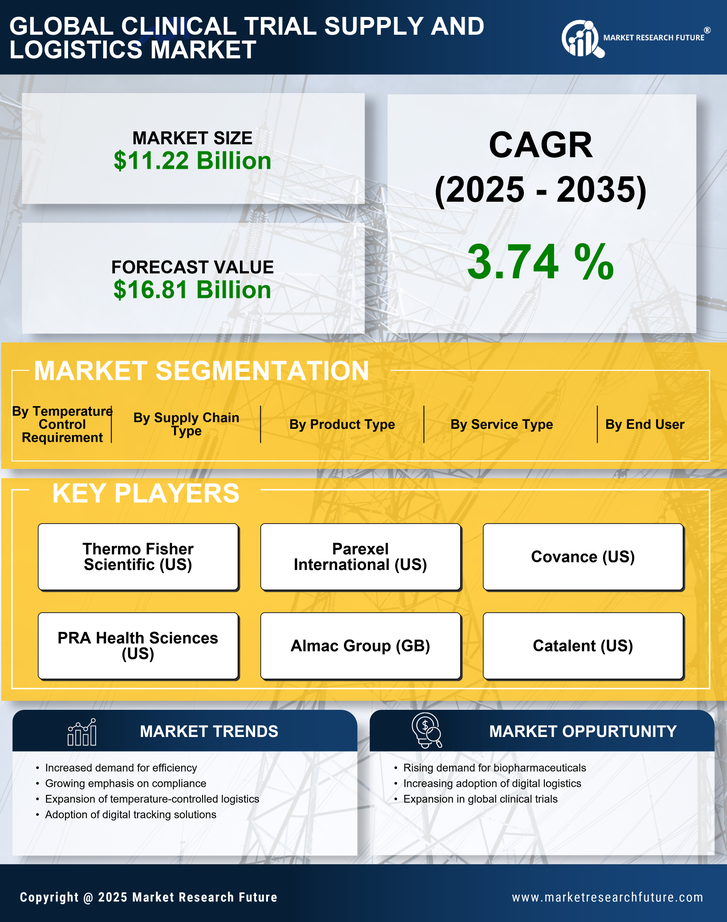

Rising Demand for Clinical Trials

The increasing prevalence of chronic diseases and the aging population are driving a surge in the demand for clinical trials. As pharmaceutical companies and research organizations seek to develop new therapies, the Clinical Trial Supply and Logistics Market is experiencing significant growth. According to recent estimates, the number of clinical trials initiated annually has risen steadily, indicating a robust pipeline of new drugs and treatments. This trend necessitates efficient supply chain management to ensure timely delivery of investigational products to trial sites. Consequently, the demand for specialized logistics services tailored to the unique requirements of clinical trials is likely to expand, further propelling the Clinical Trial Supply and Logistics Market.

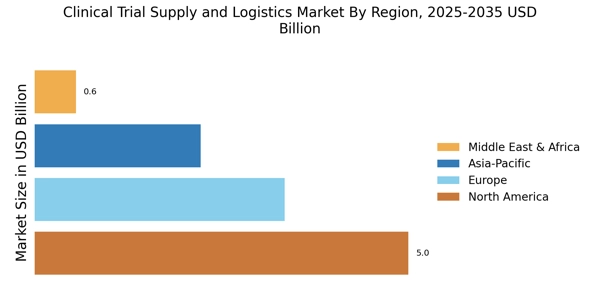

Emerging Markets and Global Expansion

Emerging markets are becoming increasingly attractive for clinical trials, driving growth in the Clinical Trial Supply and Logistics Market. Countries with developing healthcare infrastructures offer opportunities for cost-effective trial execution and access to diverse patient populations. As pharmaceutical companies seek to expand their global footprint, the logistics of managing clinical supplies across different regions become paramount. This includes navigating varying regulatory landscapes and ensuring timely delivery of materials. The potential for increased trial activity in these markets presents both challenges and opportunities for logistics providers. Companies that can effectively manage these complexities are likely to thrive in the evolving Clinical Trial Supply and Logistics Market.

Advancements in Supply Chain Technology

Technological advancements are revolutionizing the Clinical Trial Supply and Logistics Market. Innovations such as blockchain, artificial intelligence, and real-time data analytics are enhancing supply chain efficiency and transparency. These technologies facilitate better inventory management, reduce delays, and improve overall operational effectiveness. For instance, the integration of AI-driven forecasting tools allows companies to predict demand more accurately, thereby optimizing resource allocation. As the industry continues to embrace these technological solutions, the Clinical Trial Supply and Logistics Market is expected to witness substantial growth. The ability to leverage technology not only streamlines processes but also enhances the overall quality of clinical trials.

Regulatory Compliance and Quality Assurance

The Clinical Trial Supply and Logistics Market is heavily influenced by stringent regulatory requirements imposed by health authorities. Compliance with Good Distribution Practice (GDP) and Good Manufacturing Practice (GMP) is essential for ensuring the integrity and quality of clinical trial materials. As regulations evolve, companies must adapt their supply chain strategies to meet these standards. This has led to an increased focus on quality assurance processes and the implementation of advanced tracking technologies. The need for compliance not only enhances patient safety but also fosters trust among stakeholders, thereby driving growth in the Clinical Trial Supply and Logistics Market. Companies that prioritize regulatory adherence are likely to gain a competitive edge in this dynamic landscape.

Increased Focus on Patient-Centric Approaches

The shift towards patient-centric clinical trials is reshaping the Clinical Trial Supply and Logistics Market. Stakeholders are increasingly recognizing the importance of patient engagement and convenience in trial design. This has led to the development of decentralized trials, where logistics play a crucial role in delivering investigational products directly to patients' homes. Such approaches not only improve patient retention rates but also expand the pool of potential participants. As the industry adapts to these changes, the demand for innovative logistics solutions that cater to patient needs is likely to rise. This trend underscores the importance of flexibility and responsiveness in the Clinical Trial Supply and Logistics Market.