Rising Focus on Cybersecurity

The Chromebook Market is witnessing a heightened emphasis on cybersecurity, which is becoming a critical factor for consumers and organizations alike. With the increasing frequency of cyber threats, the built-in security features of Chromebooks, such as automatic updates and sandboxing, provide a compelling selling point. In 2025, it is projected that the demand for secure devices will drive a significant portion of Chromebook sales, particularly in sectors like education and healthcare, where data protection is paramount. This focus on cybersecurity not only enhances the appeal of Chromebooks but also positions the Chromebook Market as a leader in providing secure computing solutions.

Integration of Cloud-Based Services

The Chromebook Market benefits from the seamless integration of cloud-based services, which enhances the overall user experience. As more applications and storage solutions migrate to the cloud, Chromebooks, designed primarily for web-based tasks, align perfectly with this trend. The increasing reliance on cloud computing facilitates collaboration and accessibility, making Chromebooks particularly appealing to educational institutions and remote workers. In 2025, it is estimated that over 70% of Chromebook users utilize cloud services for their daily tasks, underscoring the importance of this driver. This trend not only boosts the Chromebook Market but also reinforces the relevance of cloud technology in modern computing.

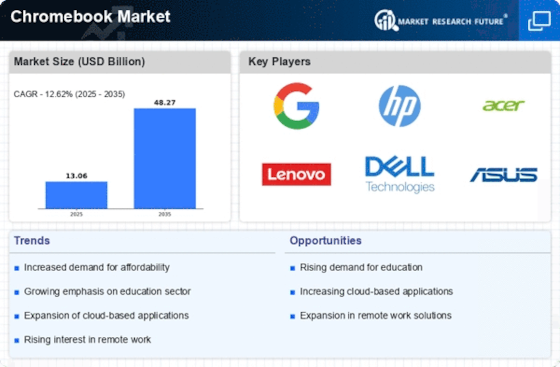

Growing Demand for Affordable Devices

The Chromebook Market experiences a notable surge in demand for affordable computing solutions. As consumers increasingly seek budget-friendly options, Chromebooks emerge as a viable alternative to traditional laptops. The average selling price of Chromebooks remains competitive, often undercutting conventional laptops by a significant margin. This affordability appeals particularly to students and budget-conscious professionals, driving sales. In 2025, the Chromebook segment is projected to capture a substantial share of the overall laptop market, indicating a shift in consumer preferences towards cost-effective technology. The emphasis on value for money positions the Chromebook Market favorably amidst rising living costs, suggesting a sustained growth trajectory.

Shift Towards Remote Learning and Work

The Chromebook Market is significantly influenced by the ongoing shift towards remote learning and work environments. As educational institutions and businesses adapt to flexible working arrangements, the demand for portable and easy-to-use devices increases. Chromebooks, with their lightweight design and user-friendly interface, cater to this need effectively. In 2025, it is anticipated that the remote work segment will account for a considerable percentage of Chromebook sales, reflecting the changing dynamics of work and education. This trend not only bolsters the Chromebook Market but also highlights the device's role in facilitating effective remote communication and collaboration.

Increased Customization and Personalization Options

The Chromebook Market is evolving with a growing emphasis on customization and personalization options for users. Manufacturers are increasingly offering a variety of models, colors, and configurations to cater to diverse consumer preferences. This trend is particularly appealing to younger demographics, who seek devices that reflect their personal style and meet their specific needs. In 2025, it is expected that the availability of customizable Chromebooks will attract a broader audience, thereby expanding the market. This focus on personalization not only enhances user satisfaction but also positions the Chromebook Market as a dynamic player in the competitive landscape of personal computing.