Rising Environmental Concerns

The Global Chromatographic Silica Resin Market Industry is influenced by rising environmental concerns and the need for sustainable practices. Industries are increasingly adopting green chemistry principles, which emphasize the use of environmentally friendly materials and processes. Chromatographic silica resins, known for their effectiveness in separation processes, are being utilized in eco-friendly applications. This shift towards sustainability is likely to drive demand for chromatographic silica resins, as companies seek to minimize their environmental footprint. The growing emphasis on sustainability suggests a positive trajectory for the Global Chromatographic Silica Resin Market Industry in the coming years.

Increasing Focus on Quality Control

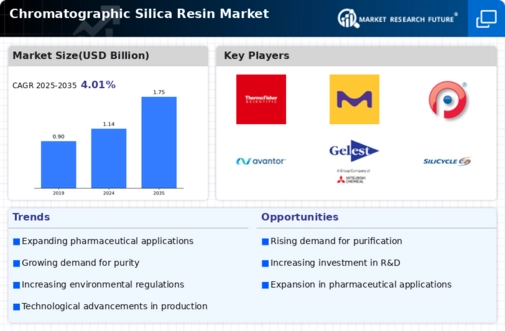

Quality control remains a critical driver for the Global Chromatographic Silica Resin Market Industry. Industries such as food and beverage, pharmaceuticals, and chemicals are increasingly implementing stringent quality assurance measures. Chromatographic silica resins play a vital role in ensuring product safety and compliance with regulatory standards. As companies strive to meet these standards, the demand for high-quality chromatographic materials is expected to rise. This trend is likely to contribute to the projected growth of the market, with estimates indicating a value of 1.75 USD Billion by 2035, reflecting the importance of quality control in various sectors.

Advancements in Analytical Techniques

Technological advancements in analytical techniques are propelling the Global Chromatographic Silica Resin Market Industry forward. Innovations in chromatography, such as high-performance liquid chromatography and ultra-high-performance liquid chromatography, enhance the efficiency and resolution of separations. These advancements enable researchers and industries to achieve better results in various applications, including environmental testing and food safety. As the demand for precise and reliable analytical results grows, the market for chromatographic silica resins is likely to expand. The continuous evolution of these technologies suggests a promising future for the Global Chromatographic Silica Resin Market Industry.

Expanding Applications Across Industries

The versatility of chromatographic silica resins is a significant driver for the Global Chromatographic Silica Resin Market Industry. These resins find applications across various sectors, including pharmaceuticals, food and beverage, and environmental analysis. The increasing need for separation and purification processes in these industries is likely to boost the demand for chromatographic silica resins. As industries continue to explore new applications and improve existing processes, the market is expected to witness steady growth. The anticipated compound annual growth rate of 3.96% from 2025 to 2035 indicates the potential for expansion within the Global Chromatographic Silica Resin Market Industry.

Growing Demand in Pharmaceutical Applications

The Global Chromatographic Silica Resin Market Industry experiences a notable increase in demand driven by the pharmaceutical sector. Chromatographic silica resins are essential for the purification and separation of active pharmaceutical ingredients. As the global pharmaceutical market continues to expand, with an estimated value of 1.14 USD Billion in 2024, the need for efficient chromatographic techniques becomes paramount. This growth is further supported by the rising focus on drug development and regulatory compliance, which necessitates high-quality separation processes. Consequently, the Global Chromatographic Silica Resin Market Industry is poised to benefit significantly from these trends.