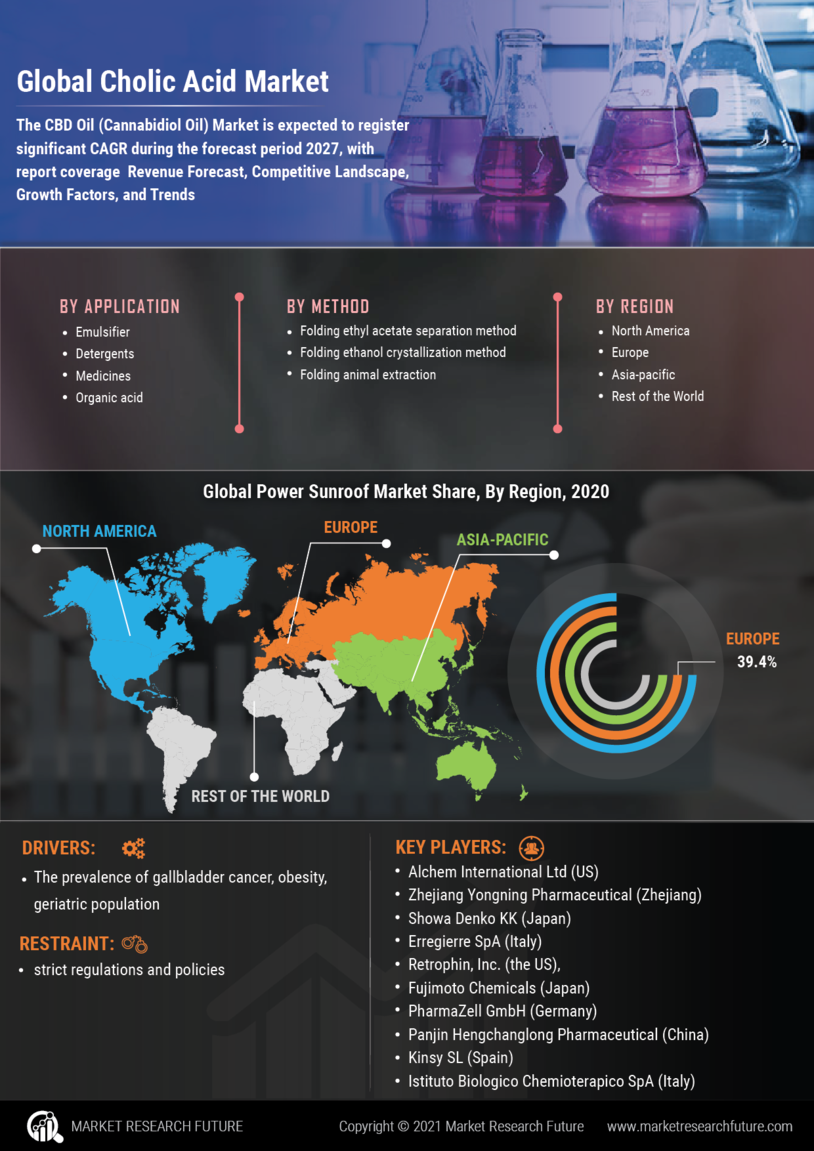

Market Growth Projections

The Global Cholic Acid Market Industry is projected to experience substantial growth over the next decade. With a compound annual growth rate (CAGR) of 11.18% anticipated from 2025 to 2035, the market is expected to expand significantly. This growth is driven by various factors, including the rising demand for bile acid derivatives and the increasing applications in pharmaceuticals. The market size is forecasted to reach 328.3 USD Million by 2035, reflecting the growing recognition of cholic acid's therapeutic potential. These projections underscore the dynamic nature of the Global Cholic Acid Market Industry and its capacity to adapt to evolving market demands.

Rising Demand for Bile Acid Derivatives

The Global Cholic Acid Market Industry experiences a notable increase in demand for bile acid derivatives, which are essential for various pharmaceutical applications. As bile acids play a crucial role in digestion and metabolism, their derivatives are increasingly utilized in drug formulations. This trend is driven by the growing prevalence of metabolic disorders and liver diseases, which require effective treatment options. The market is projected to reach 102.3 USD Million in 2024, reflecting a robust growth trajectory. The rising awareness of the therapeutic potential of bile acids further propels this demand, indicating a promising outlook for the Global Cholic Acid Market Industry.

Expansion of Pharmaceutical Applications

The Global Cholic Acid Market Industry is significantly influenced by the expansion of pharmaceutical applications. Cholic acid Market is increasingly recognized for its role in drug development, particularly in the formulation of novel therapeutics. Its unique properties facilitate the solubilization of poorly soluble drugs, enhancing bioavailability and therapeutic efficacy. As pharmaceutical companies invest in research and development, the utilization of cholic acid in innovative drug formulations is expected to rise. This trend is anticipated to contribute to the market's growth, with projections indicating a market size of 328.3 USD Million by 2035, highlighting the potential of cholic acid in the pharmaceutical sector.

Growing Interest in Natural and Organic Products

The Global Cholic Acid Market Industry is witnessing a shift towards natural and organic products, driven by consumer preferences for health and wellness. Cholic acid Market, derived from natural sources, aligns with the increasing demand for clean-label ingredients in dietary supplements and functional foods. This trend is particularly prominent in regions where consumers prioritize transparency and sustainability in product sourcing. As manufacturers respond to this demand by incorporating cholic acid into their offerings, the market is likely to benefit from this growing interest. This shift towards natural products may further enhance the market's growth potential in the coming years.

Increasing Research Activities and Clinical Trials

The Global Cholic Acid Market Industry is bolstered by increasing research activities and clinical trials focusing on the therapeutic applications of cholic acid. Researchers are exploring its potential in treating various conditions, including metabolic disorders and liver diseases. The growing body of scientific literature and clinical evidence supports the efficacy of cholic acid in these applications, attracting interest from pharmaceutical companies. As more clinical trials are initiated, the market is expected to witness a surge in demand for cholic acid, further solidifying its position in the pharmaceutical landscape. This trend indicates a promising future for the Global Cholic Acid Market Industry.

Technological Advancements in Production Processes

Technological advancements in production processes are playing a pivotal role in shaping the Global Cholic Acid Market Industry. Innovations in extraction and synthesis methods have led to improved efficiency and cost-effectiveness in cholic acid production. These advancements not only enhance the quality of the final product but also contribute to sustainability by reducing waste and energy consumption. As manufacturers adopt these technologies, the overall supply chain becomes more robust, facilitating a steady supply of cholic acid to meet the growing demand. This trend is likely to support the market's expansion, particularly as production capabilities are optimized.