Market Growth Projections

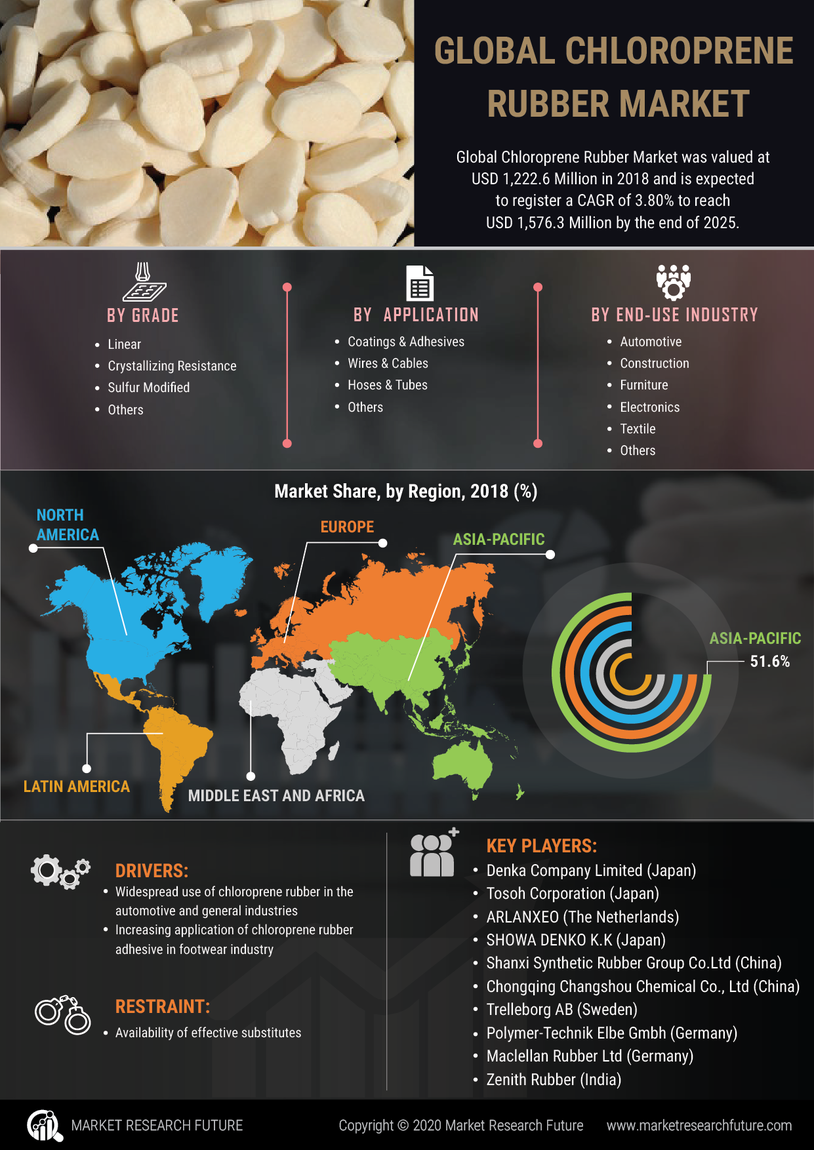

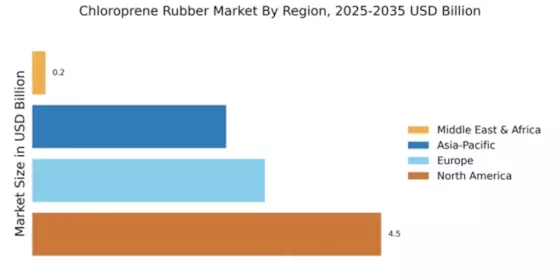

The Global Chloroprene Rubber Market Industry is projected to experience substantial growth, with estimates indicating a market value of 0.72 USD Billion in 2024 and a remarkable increase to 1.97 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 9.57% from 2025 to 2035, reflecting the expanding applications and increasing demand across various sectors. The anticipated growth is driven by factors such as rising automotive production, expanding construction activities, and technological advancements in manufacturing processes. These projections underscore the potential for chloroprene rubber to play a pivotal role in multiple industries in the coming years.

Growth in Construction Activities

The Global Chloroprene Rubber Market Industry benefits from the expanding construction sector, where chloroprene rubber is utilized for its adhesive properties and resistance to environmental factors. As urbanization accelerates globally, the demand for construction materials that offer longevity and reliability increases. Chloroprene rubber is particularly favored for roofing and flooring applications, where its resilience to weathering is crucial. This growth in construction activities is anticipated to contribute significantly to the market, with forecasts indicating a rise to 1.97 USD Billion by 2035. The ongoing infrastructure projects across various regions further underscore the potential of the Global Chloroprene Rubber Market Industry.

Increasing Environmental Regulations

The Global Chloroprene Rubber Market Industry is influenced by increasing environmental regulations that promote the use of sustainable materials. As governments worldwide implement stricter guidelines on emissions and waste management, manufacturers are compelled to adopt eco-friendly practices. Chloroprene rubber, known for its low environmental impact compared to other synthetic rubbers, stands to benefit from this trend. The shift towards sustainability is likely to enhance the market's appeal, as industries seek compliant materials that do not compromise performance. This regulatory landscape may drive innovation and adaptation within the Global Chloroprene Rubber Market Industry, fostering a more sustainable future.

Rising Demand from Automotive Sector

The Global Chloroprene Rubber Market Industry experiences a notable surge in demand from the automotive sector, primarily due to its excellent properties such as heat resistance and durability. As automotive manufacturers increasingly prioritize high-performance materials, chloroprene rubber finds applications in seals, gaskets, and hoses. This trend is expected to drive the market's growth, with projections indicating a market value of 0.72 USD Billion in 2024. The automotive industry's shift towards lightweight and efficient materials further enhances the relevance of chloroprene rubber, suggesting a robust trajectory for the Global Chloroprene Rubber Market Industry in the coming years.

Diverse Applications Across Industries

The versatility of chloroprene rubber across various industries significantly contributes to the growth of the Global Chloroprene Rubber Market Industry. Its applications span automotive, construction, electronics, and healthcare, among others. This diversity allows for a broad customer base and mitigates risks associated with market fluctuations in any single sector. As industries continue to evolve and seek specialized materials, chloroprene rubber's unique properties, such as chemical resistance and flexibility, make it a preferred choice. This broad applicability is expected to sustain market growth, with projections indicating a steady increase in demand over the next decade.

Technological Advancements in Manufacturing

Technological advancements in the manufacturing processes of chloroprene rubber are poised to enhance production efficiency and product quality. Innovations in polymerization techniques and compounding methods enable manufacturers to produce chloroprene rubber with superior characteristics, catering to diverse applications. These advancements not only improve the performance of the material but also reduce production costs, making it more accessible to various industries. As a result, the Global Chloroprene Rubber Market Industry is likely to witness accelerated growth, with a projected CAGR of 9.57% from 2025 to 2035. This technological evolution is expected to create new opportunities for market players.