Emergence of 5G Technology

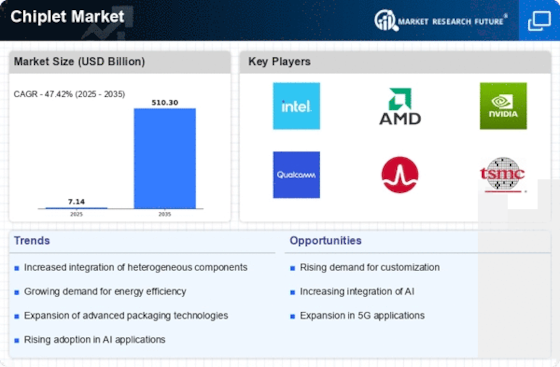

The emergence of 5G technology is poised to have a profound impact on the Chiplet Market. With the rollout of 5G networks, there is a growing demand for advanced semiconductor solutions that can support higher data rates and lower latency. Chiplets, with their modular design, can facilitate the integration of various communication protocols and functionalities, making them ideal for 5G applications. The telecommunications sector is expected to invest heavily in infrastructure to support 5G, with projections indicating a multi-billion dollar market opportunity. This investment is likely to drive the adoption of chiplet technology, as companies seek to develop innovative solutions that meet the demands of next-generation connectivity. The Chiplet Market is thus positioned to benefit from the rapid advancements in 5G technology.

Growing Focus on Energy Efficiency

The Chiplet Market is increasingly driven by a growing focus on energy efficiency across various sectors. As environmental concerns rise, companies are seeking solutions that minimize energy consumption while maintaining performance. Chiplets, with their ability to integrate multiple functions into a single die, can significantly reduce power usage compared to traditional monolithic designs. Recent studies indicate that energy-efficient designs can lead to a reduction in operational costs by up to 30%. This trend is likely to propel the adoption of chiplet technology, as organizations aim to meet sustainability goals while optimizing performance. The Chiplet Market is thus well-positioned to capitalize on this shift towards energy-efficient solutions.

Advancements in Semiconductor Technology

Technological advancements in semiconductor manufacturing are significantly influencing the Chiplet Market. Innovations such as extreme ultraviolet lithography and advanced packaging techniques are enabling the production of smaller, more efficient chiplets. These advancements facilitate the integration of multiple functionalities into a single package, enhancing performance and reducing power consumption. The semiconductor industry has seen a substantial investment in research and development, with expenditures reaching billions annually. This investment is likely to yield new materials and processes that further optimize chiplet designs. As a result, the Chiplet Market stands to gain from these technological breakthroughs, which may lead to more efficient and cost-effective solutions for various applications.

Rising Demand for High-Performance Computing

The Chiplet Market is experiencing a notable surge in demand for high-performance computing solutions. As industries increasingly rely on data-intensive applications, the need for efficient processing capabilities becomes paramount. Chiplets, with their modular architecture, allow for the integration of diverse functionalities, catering to the specific requirements of various applications. According to recent data, the market for high-performance computing is projected to grow at a compound annual growth rate of over 10% in the coming years. This growth is likely to drive the adoption of chiplet technology, as companies seek to enhance performance while managing costs. The Chiplet Market is thus positioned to benefit from this trend, as it offers scalable solutions that can be tailored to meet the evolving demands of high-performance computing.

Increased Investment in AI and Machine Learning

The Chiplet Market is witnessing increased investment in artificial intelligence and machine learning technologies. As organizations strive to harness the power of AI, the demand for specialized hardware that can efficiently process large datasets is growing. Chiplets offer a flexible architecture that can be tailored to the specific needs of AI applications, enabling faster processing and improved performance. Market data suggests that the AI hardware market is expected to reach several billion dollars in the next few years, driving the need for innovative chiplet solutions. This trend indicates a promising future for the Chiplet Market, as it aligns with the increasing reliance on AI and machine learning across various sectors.