Regulatory Support for Telecom Expansion

The regulatory environment in China is playing a crucial role in shaping the wholesale telecom-carrier market. The government has implemented policies aimed at promoting the expansion of telecom infrastructure, particularly in underserved regions. As of 2025, initiatives such as the 'Broadband China' strategy are facilitating investments in rural areas, thereby increasing access to telecom services. This regulatory support is likely to stimulate growth in the wholesale telecom-carrier market by encouraging carriers to expand their networks. Furthermore, the government is actively working to streamline licensing processes, making it easier for new entrants to join the market. This supportive regulatory framework is expected to enhance competition and drive innovation, ultimately benefiting consumers through improved service availability and quality.

Growing Internet Penetration and Mobile Usage

China's wholesale telecom-carrier market is significantly influenced by the increasing internet penetration and mobile device usage. As of late 2025, approximately 1.2 billion people in China are estimated to be internet users, representing a penetration rate of around 85%. This widespread access to the internet is driving demand for data services, particularly among mobile users. The wholesale telecom-carrier market is adapting to this trend by expanding their service offerings to cater to the growing number of mobile subscribers. Additionally, the rise of mobile applications and digital services is creating new revenue streams for carriers. This trend suggests that the market will continue to evolve, with carriers focusing on enhancing mobile data plans and services to meet the needs of an increasingly connected population.

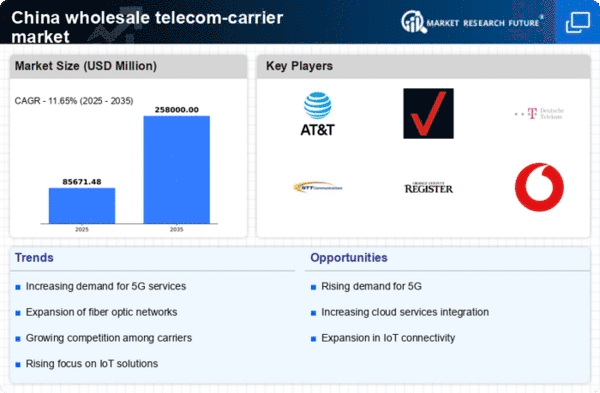

Increased Competition Among Telecom Providers

The competitive landscape of the wholesale telecom-carrier market in China is intensifying as new players enter the market. Established carriers are facing pressure from emerging companies that offer innovative solutions and competitive pricing. This competition is likely to drive down prices, benefiting consumers and businesses alike. As of 2025, the market is characterized by a diverse range of service providers, each vying for market share. The wholesale telecom-carrier market is witnessing a shift towards customer-centric services, with providers focusing on personalized offerings and enhanced customer support. This competitive environment may lead to strategic partnerships and mergers as companies seek to consolidate their positions. Overall, the increased competition is expected to foster innovation and improve service quality across the market.

Rising Demand for Cloud Services and IoT Solutions

The wholesale telecom-carrier market in China is witnessing a surge in demand for cloud services and Internet of Things (IoT) solutions. As businesses increasingly adopt digital transformation strategies, the need for reliable connectivity and data management solutions is growing. By 2025, the market for IoT devices is projected to reach over 1 billion units, creating substantial opportunities for telecom carriers. The wholesale telecom-carrier market is responding by developing tailored solutions that cater to the specific needs of businesses, such as enhanced data security and low-latency connectivity. This trend indicates a shift towards more integrated service offerings, where carriers not only provide connectivity but also value-added services that support the digital ecosystem. As a result, the market is likely to evolve, with carriers positioning themselves as key enablers of digital transformation.

Technological Advancements in Network Infrastructure

The wholesale telecom-carrier market in China is experiencing a notable transformation due to rapid technological advancements. Innovations such as 5G technology and fiber-optic networks are enhancing the capacity and speed of data transmission. As of 2025, the deployment of 5G networks is projected to cover over 80% of urban areas, significantly increasing the demand for data services. This shift is compelling carriers to invest in modern infrastructure to remain competitive. The wholesale telecom-carrier market is thus witnessing a surge in partnerships and collaborations aimed at upgrading existing networks. These advancements not only improve service quality but also reduce operational costs, allowing carriers to offer more competitive pricing. Consequently, the market is likely to see an influx of new entrants, further intensifying competition and driving innovation.