Rising Mobile Data Consumption

The increasing reliance on mobile devices for internet access is significantly impacting the wholesale telecom-carrier market in India. With mobile data consumption projected to grow at a CAGR of 30% over the next five years, carriers are compelled to enhance their data offerings. This surge in demand for mobile data services is likely to lead to a corresponding increase in wholesale data traffic, compelling carriers to invest in more robust infrastructure. As a result, the wholesale telecom-carrier market is expected to grow as carriers capitalize on this trend by offering competitive pricing and innovative data packages to attract more customers.

Emergence of New Business Models

The wholesale telecom-carrier market in India is witnessing the emergence of innovative business models that are reshaping the competitive landscape. With the rise of over-the-top (OTT) services and digital content providers, traditional carriers are exploring new revenue streams beyond conventional voice and data services. This shift is prompting carriers to develop partnerships with content providers and invest in value-added services, which could enhance their appeal to wholesale customers. As these new business models gain traction, they are likely to stimulate growth in the wholesale telecom-carrier market, as carriers adapt to changing consumer preferences and seek to capture a larger share of the digital economy.

Regulatory Framework Enhancements

The regulatory environment in India is evolving, which appears to be fostering growth in the wholesale telecom-carrier market. Recent initiatives by the Telecom Regulatory Authority of India (TRAI) aim to simplify licensing processes and reduce compliance burdens for carriers. These regulatory enhancements are likely to encourage new entrants into the market, thereby increasing competition and driving innovation. Additionally, the government's push for digital inclusion and broadband penetration is expected to create new opportunities for wholesale carriers, as they seek to provide services to underserved regions. This regulatory support could potentially lead to a more dynamic and competitive wholesale telecom-carrier market.

Increased Focus on Cost Efficiency

Cost efficiency is becoming a critical driver in the wholesale telecom-carrier market in India. As competition intensifies, carriers are increasingly seeking ways to optimize their operational costs. This focus on cost efficiency is likely to lead to the adoption of more streamlined processes and technologies, such as cloud-based solutions and automation. By reducing operational expenditures, carriers can offer more competitive pricing to their wholesale customers, which may enhance their market position. Furthermore, the emphasis on cost efficiency could also encourage partnerships and collaborations among carriers, enabling them to share resources and infrastructure, thereby driving growth in the wholesale telecom-carrier market.

Technological Advancements in Infrastructure

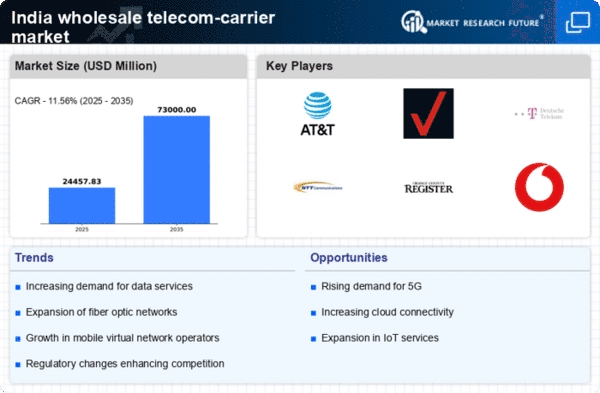

the wholesale telecom-carrier market in India is undergoing a notable transformation due to rapid technological advancements in infrastructure. Innovations such as 5G technology and fiber-optic networks are enhancing the capacity and speed of data transmission. As of 2025, the Indian telecom sector is projected to invest approximately $10 billion in upgrading existing infrastructure to support these advancements. This investment is likely to facilitate improved service delivery and attract more customers, thereby driving growth in the wholesale telecom-carrier market. Furthermore, the integration of artificial intelligence and machine learning in network management is expected to optimize operations, reduce costs, and enhance customer experience, which could further stimulate demand in the market.