Rising Demand for Digital Twins

The concept of digital twins is gaining traction within the China virtual engineering market. Digital twins allow for real-time simulation and monitoring of physical assets, enabling companies to optimize performance and reduce downtime. Industries such as manufacturing, construction, and energy are increasingly adopting this technology to enhance operational efficiency. According to recent estimates, the digital twin market in China is expected to reach USD 20 billion by 2025. This rising demand is indicative of a broader trend towards digital transformation in engineering practices, as companies seek to leverage data-driven insights for better decision-making.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence and machine learning is a pivotal driver in the China virtual engineering market. These technologies enhance design processes, optimize resource allocation, and improve predictive maintenance. For instance, AI algorithms can analyze vast datasets to identify patterns and anomalies, leading to more efficient engineering solutions. The Chinese government has been actively promoting the adoption of these technologies through various initiatives, which has resulted in a projected growth rate of 15% annually in the virtual engineering sector. This integration not only streamlines operations but also fosters innovation, positioning China as a leader in the global virtual engineering landscape.

Government Support and Policy Framework

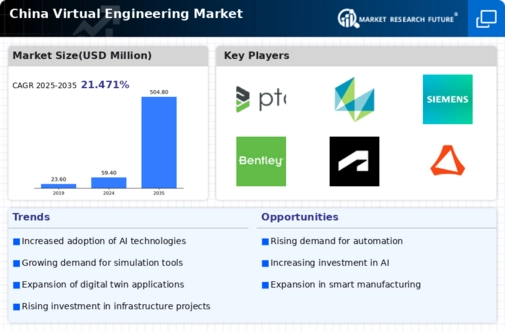

The Chinese government plays a significant role in shaping the virtual engineering market through supportive policies and funding initiatives. The 'Made in China 2025' strategy emphasizes the importance of advanced manufacturing and digital technologies, including virtual engineering. This policy framework has led to increased investments in research and development, fostering innovation within the sector. Furthermore, government grants and subsidies for technology adoption have encouraged companies to integrate virtual engineering solutions into their operations. As a result, the market is projected to grow at a compound annual growth rate of 12% over the next five years, driven by this robust governmental support.

Collaboration and Partnerships in Innovation

Collaboration among industry players, academic institutions, and research organizations is a key driver in the China virtual engineering market. Such partnerships facilitate knowledge sharing and accelerate the development of innovative solutions. For example, joint ventures between technology firms and universities have led to breakthroughs in virtual engineering applications. The Chinese government encourages these collaborations through funding programs and innovation hubs, which aim to foster a culture of research and development. This collaborative approach is expected to enhance the competitiveness of the Chinese virtual engineering market, potentially leading to a market expansion of 10% annually as new technologies and methodologies are developed.

Focus on Sustainability and Green Engineering

Sustainability has emerged as a crucial driver in the China virtual engineering market. With increasing environmental concerns, there is a growing emphasis on green engineering practices. Companies are adopting virtual engineering solutions to minimize waste and optimize energy consumption. The Chinese government has set ambitious targets for carbon neutrality by 2060, which has led to increased investments in sustainable technologies. Reports indicate that the market for sustainable engineering solutions in China is expected to reach USD 50 billion by 2027. This focus on sustainability not only aligns with global trends but also enhances the competitiveness of Chinese firms in the international arena.