Expansion of Veterinary Services

The veterinary ct-scanner market is benefiting from the expansion of veterinary services across China. As the number of veterinary clinics and hospitals increases, so does the need for advanced diagnostic tools. This expansion is fueled by rising pet ownership and a growing emphasis on animal health. In urban areas, the proliferation of specialized veterinary practices is particularly evident, with many facilities now offering comprehensive imaging services. This trend is expected to contribute to a market growth rate of approximately 12% annually, as more veterinary professionals recognize the value of ct-scanners in providing precise diagnostics and treatment plans.

Rising Awareness of Animal Health

The veterinary ct-scanner market is also influenced by increased awareness of animal health among pet owners in China. As more individuals prioritize the well-being of their pets, there is a growing demand for advanced diagnostic tools that can facilitate timely and accurate medical interventions. This heightened awareness is likely to drive veterinary practices to invest in ct-scanners, thereby enhancing their diagnostic capabilities. Market analysts project that this trend could lead to a 15% increase in the adoption of imaging technologies over the next few years, as pet owners seek out veterinary services that offer comprehensive diagnostic options.

Government Initiatives and Support

Government initiatives aimed at improving animal health standards are positively impacting the veterinary ct-scanner market. In recent years, the Chinese government has implemented various policies to promote veterinary care and enhance the quality of services provided. These initiatives include funding for veterinary education and subsidies for advanced medical equipment, which are likely to encourage veterinary practices to invest in ct-scanners. As a result, the market is expected to grow at a rate of approximately 8% annually, as more veterinary facilities become equipped with state-of-the-art imaging technologies, ultimately benefiting animal health and welfare.

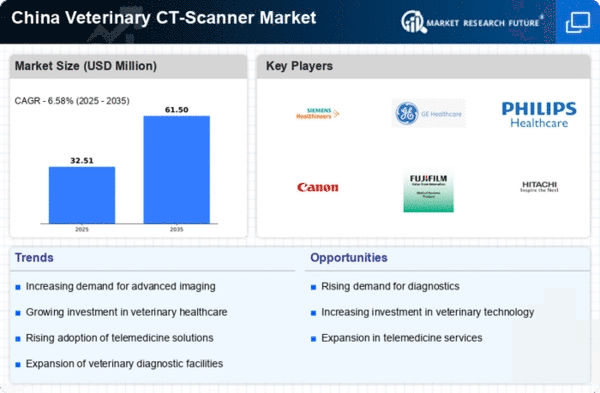

Increasing Demand for Diagnostic Imaging

The veterinary ct-scanner market in China is experiencing a notable surge in demand for advanced diagnostic imaging solutions. This trend is largely driven by the growing awareness among pet owners regarding the importance of early disease detection and accurate diagnosis. As veterinary practices increasingly adopt sophisticated imaging technologies, the market is projected to expand significantly. In 2025, the market is estimated to reach approximately $150 million, reflecting a compound annual growth rate (CAGR) of around 10% over the next five years. This increasing demand for diagnostic imaging is likely to enhance the capabilities of veterinary professionals, thereby improving patient outcomes and fostering trust among pet owners.

Technological Innovations in Imaging Equipment

Technological innovations are playing a crucial role in shaping the veterinary ct-scanner market. The introduction of more compact, efficient, and cost-effective imaging systems is making these technologies accessible to a broader range of veterinary practices. Enhanced imaging capabilities, such as improved resolution and faster scanning times, are likely to attract more veterinary professionals to adopt ct-scanners. As of 2025, it is anticipated that the market will witness a shift towards portable and user-friendly devices, which could account for up to 30% of total sales. This trend indicates a significant transformation in how veterinary diagnostics are conducted, ultimately benefiting animal health.