Expansion of Veterinary Practices

The expansion of veterinary practices across the United States is significantly influencing the veterinary ct-scanner market. As more veterinary clinics and hospitals open, there is a corresponding need for advanced imaging technologies to meet the growing patient demand. This expansion is not only limited to urban areas but is also extending into rural regions, where access to veterinary care is improving. The increasing number of veterinary facilities is expected to drive the market for veterinary ct-scanners, as these tools are essential for providing high-quality care. The veterinary ct-scanner market is likely to benefit from this trend, as more practices invest in state-of-the-art diagnostic equipment.

Rising Incidence of Pet Health Issues

The rising incidence of health issues among pets is a critical driver for the veterinary ct-scanner market. With an increase in conditions such as cancer, orthopedic disorders, and neurological diseases, veterinarians are increasingly relying on advanced imaging techniques to diagnose and treat these ailments. The American Veterinary Medical Association reports that pet owners are more willing to invest in advanced diagnostic procedures, which has led to a surge in the use of CT scanners. This trend indicates a growing awareness of pet health and the importance of early detection, thereby enhancing the demand for veterinary ct-scanners in the market.

Growing Demand for Advanced Diagnostic Tools

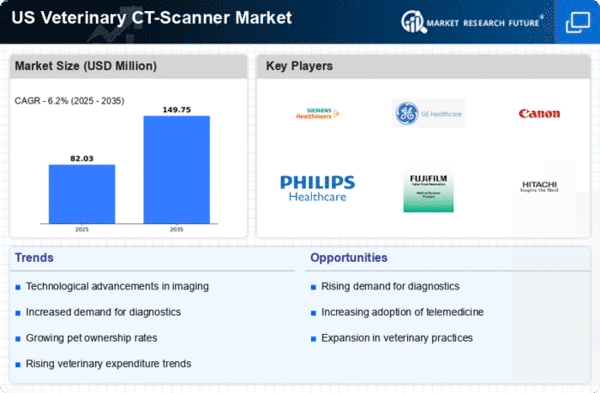

The veterinary ct-scanner market is experiencing a notable increase in demand for advanced diagnostic tools. As veterinary practices strive to enhance their diagnostic capabilities, the adoption of CT scanners has become more prevalent. This trend is driven by the need for precise imaging to diagnose complex conditions in pets. According to recent data, the market for veterinary imaging equipment, including CT scanners, is projected to grow at a CAGR of approximately 8% over the next few years. This growth reflects the increasing recognition of the importance of accurate diagnostics in veterinary medicine, thereby propelling the veterinary ct-scanner market forward.

Increased Investment in Veterinary Healthcare

Increased investment in veterinary healthcare is a significant factor driving the veterinary ct-scanner market. As pet owners become more aware of the importance of veterinary care, they are willing to spend more on advanced diagnostic services. This trend is reflected in the growing number of veterinary practices that are upgrading their equipment to include CT scanners. Furthermore, veterinary schools and research institutions are also investing in advanced imaging technologies for educational and research purposes. This influx of investment is likely to bolster the veterinary ct-scanner market, as more facilities seek to provide high-quality diagnostic services.

Technological Integration in Veterinary Practices

The integration of technology in veterinary practices is reshaping the landscape of the veterinary ct-scanner market. Innovations such as cloud-based imaging systems and AI-driven diagnostic tools are becoming more common, allowing for improved efficiency and accuracy in diagnostics. This technological evolution is encouraging veterinary practices to adopt CT scanners that are compatible with these advancements. As practices seek to streamline operations and enhance patient care, the demand for technologically advanced veterinary ct-scanners is expected to rise. This trend suggests a shift towards more sophisticated imaging solutions in the veterinary sector.