Expansion of E-Commerce Platforms

The rapid expansion of e-commerce platforms in China is significantly influencing the synthetic monitoring market. With the increasing number of online transactions, businesses are compelled to ensure that their websites and applications function seamlessly. Synthetic monitoring tools provide critical insights into website performance, enabling companies to identify and rectify issues before they impact customer experience. In 2025, it is estimated that e-commerce sales in China will reach over $2 trillion, further emphasizing the need for robust monitoring solutions. The synthetic monitoring market is likely to see substantial growth as e-commerce businesses prioritize the reliability and speed of their digital interfaces to meet consumer expectations.

Increased Focus on Digital Transformation

The ongoing digital transformation across various sectors in China is driving the growth of the synthetic monitoring market. Organizations are increasingly adopting digital technologies to enhance operational efficiency and customer engagement. This shift necessitates the implementation of synthetic monitoring solutions to ensure that digital services are performing optimally. In 2025, it is projected that over 70% of enterprises in China will have undergone some form of digital transformation, highlighting the critical role of monitoring tools in this process. The synthetic monitoring market is thus likely to expand as businesses seek to leverage these solutions to support their digital initiatives.

Growing Awareness of Cybersecurity Threats

As cybersecurity threats continue to evolve, there is a growing awareness among businesses in China regarding the importance of safeguarding their digital assets. The synthetic monitoring market is benefiting from this heightened focus on cybersecurity, as organizations recognize the need for comprehensive monitoring solutions that can detect vulnerabilities and performance issues. In 2025, it is anticipated that cybersecurity spending in China will exceed $30 billion, reflecting the urgency to protect digital infrastructures. The synthetic monitoring market is poised for growth as companies invest in monitoring tools that not only enhance performance but also bolster security measures.

Rising Demand for Performance Optimization

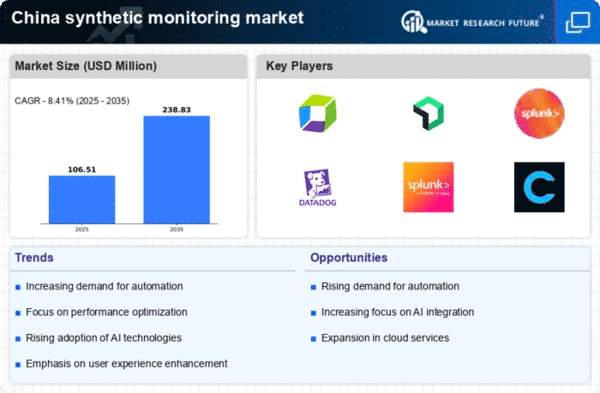

The synthetic monitoring market in China is experiencing a notable surge in demand for performance optimization solutions. As businesses increasingly rely on digital platforms, the need for real-time monitoring of application performance has become paramount. Companies are investing in synthetic monitoring tools to ensure optimal user experiences and minimize downtime. In 2025, the market is projected to grow at a CAGR of approximately 15%, driven by the necessity for businesses to maintain competitive advantages. This growth is indicative of a broader trend where organizations prioritize performance metrics to enhance operational efficiency. The synthetic monitoring market is thus positioned to benefit from this rising demand, as enterprises seek to leverage data-driven insights to refine their digital strategies.

Technological Advancements in Monitoring Tools

Technological advancements are playing a crucial role in shaping the synthetic monitoring market in China. Innovations such as AI and machine learning are enhancing the capabilities of monitoring tools, allowing for more accurate and predictive analytics. These advancements enable businesses to proactively address performance issues, thereby improving user satisfaction. As of November 2025, the market is witnessing a shift towards more sophisticated monitoring solutions that integrate seamlessly with existing IT infrastructures. The synthetic monitoring market is expected to thrive as organizations adopt these advanced tools to gain a competitive edge in an increasingly digital landscape.