Increased Focus on Data Security

The rising concerns regarding data security in China are driving the synthetic data-generation market. Organizations are increasingly aware of the risks associated with data breaches and are seeking solutions that minimize exposure to sensitive information. Synthetic data provides a secure alternative, allowing companies to conduct analyses and develop models without relying on real data. This shift towards data security is expected to propel market growth, with an estimated 30% of enterprises adopting synthetic data solutions by 2025. As businesses prioritize safeguarding their data assets, the synthetic data-generation market is likely to expand, offering innovative solutions that address security challenges.

Advancements in Machine Learning and AI

The rapid advancements in machine learning and artificial intelligence technologies are significantly impacting the synthetic data-generation market. As AI models require vast amounts of data for training, synthetic data serves as a crucial resource, enabling the development of robust algorithms without the constraints of real-world data limitations. In 2025, the market is expected to benefit from a projected increase in AI investments, which could reach $10 billion in China. This influx of capital is likely to enhance the capabilities of synthetic data generation tools, fostering innovation and expanding their applications across various industries, including automotive, finance, and healthcare.

Growing Demand for Data-Driven Insights

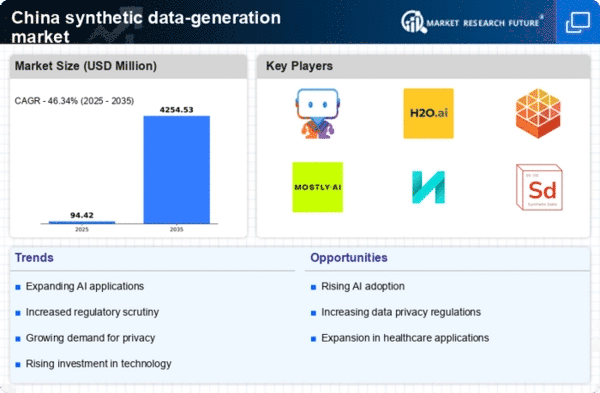

The increasing need for data-driven insights across various sectors in China is propelling the synthetic data-generation market. Organizations are recognizing the value of data analytics in enhancing decision-making processes. In 2025, the market is projected to reach approximately $1.5 billion, reflecting a compound annual growth rate (CAGR) of around 25%. This growth is largely attributed to the rising emphasis on data utilization in sectors such as finance, retail, and manufacturing. As businesses strive to leverage data for competitive advantage, the synthetic data-generation market is likely to experience heightened demand, enabling companies to create realistic datasets for training algorithms and improving operational efficiency.

Regulatory Compliance and Data Governance

In China, stringent regulations surrounding data privacy and protection are influencing the synthetic data-generation market. The implementation of laws such as the Personal Information Protection Law (PIPL) necessitates organizations to adopt compliant data practices. Synthetic data offers a viable solution, allowing companies to generate datasets that do not compromise personal information. This trend is expected to drive market growth, as businesses seek to align with regulatory requirements while still harnessing the power of data. By 2025, it is anticipated that the market will see a surge in adoption, with an estimated 40% of organizations utilizing synthetic data to ensure compliance and mitigate risks associated with data breaches.

Expansion of Digital Transformation Initiatives

The ongoing digital transformation initiatives across various sectors in China are contributing to the growth of the synthetic data-generation market. As organizations embrace digital technologies, the demand for high-quality data to support these transformations is increasing. Synthetic data can facilitate this process by providing realistic datasets for testing and validation purposes. By 2025, it is projected that the market will witness a significant uptick, with an estimated growth rate of 20% as companies leverage synthetic data to enhance their digital capabilities. This trend indicates a broader acceptance of synthetic data as a critical component in the digital transformation journey.