Rising Demand for Precision Surgery

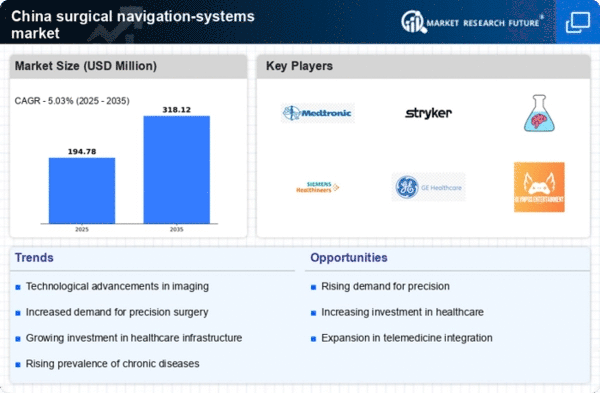

The surgical navigation-systems market is experiencing a notable increase in demand for precision surgery in China. As healthcare providers strive to enhance surgical outcomes, the adoption of advanced navigation systems becomes essential. These systems facilitate accurate positioning and tracking during procedures, thereby reducing the risk of complications. According to recent data, the market for surgical navigation systems in China is projected to grow at a CAGR of approximately 12% over the next five years. This growth is driven by the increasing prevalence of chronic diseases and the need for complex surgical interventions, which necessitate the use of sophisticated navigation technologies. Furthermore, the emphasis on patient safety and improved recovery times is likely to propel the adoption of these systems, making them a critical component in modern surgical practices.

Growing Awareness of Surgical Safety

The increasing awareness of surgical safety among patients and healthcare professionals is a driving force in the surgical navigation-systems market. In China, there is a heightened focus on minimizing surgical errors and enhancing patient outcomes. This awareness has led to a greater demand for technologies that can provide real-time guidance during surgical procedures. Surgical navigation systems, which offer precise tracking and visualization, are becoming indispensable tools in this context. Surveys indicate that over 70% of surgeons in China believe that navigation systems significantly improve surgical accuracy. As a result, hospitals are more inclined to invest in these technologies, thereby fostering growth in the surgical navigation-systems market. This trend underscores the importance of integrating safety-enhancing technologies into surgical practices.

Technological Advancements in Imaging

Technological advancements in imaging modalities are reshaping the surgical navigation-systems market in China. Innovations such as 3D imaging, augmented reality, and intraoperative imaging are enhancing the capabilities of navigation systems. These technologies allow for better visualization of anatomical structures, which is crucial for complex surgeries. The integration of advanced imaging techniques with navigation systems is expected to improve surgical precision and reduce operation times. As of 2025, the market for imaging technologies in surgical navigation is anticipated to grow by approximately 15%, driven by the demand for enhanced visualization tools. This growth indicates a shift towards more sophisticated surgical techniques, where navigation systems play a pivotal role in ensuring successful outcomes.

Investment in Healthcare Infrastructure

China's ongoing investment in healthcare infrastructure significantly impacts the surgical navigation-systems market. The government has been allocating substantial funds to upgrade medical facilities and enhance surgical capabilities. This investment is reflected in the establishment of advanced surgical centers equipped with state-of-the-art navigation systems. As of 2025, it is estimated that healthcare spending in China will reach approximately $1 trillion, with a considerable portion directed towards surgical technologies. This financial commitment not only improves access to advanced surgical procedures but also encourages the integration of innovative navigation systems. Consequently, the surgical navigation-systems market is likely to benefit from this trend, as hospitals and surgical centers seek to adopt cutting-edge technologies to improve patient care and operational efficiency.

Increasing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases in China is a significant driver of the surgical navigation-systems market. Conditions such as cardiovascular diseases, diabetes, and obesity are leading to an increase in surgical interventions. As the population ages and lifestyle-related health issues become more common, the demand for surgical procedures is expected to rise. This trend necessitates the use of advanced surgical navigation systems to ensure precision and safety during operations. Reports suggest that the number of surgical procedures in China could increase by over 20% in the next five years, further propelling the need for navigation technologies. Consequently, the surgical navigation-systems market is likely to expand as healthcare providers seek to adopt solutions that enhance surgical efficacy and patient safety.