Rising Cybersecurity Threats

The software defined-security market in China is experiencing growth due to the increasing frequency and sophistication of cyber threats. As organizations face a surge in ransomware attacks and data breaches, the demand for advanced security solutions is escalating. In 2025, it is estimated that cybercrime could cost the global economy over $10 trillion annually, prompting Chinese enterprises to invest heavily in software defined-security solutions. This trend indicates a shift towards proactive security measures, as businesses seek to protect sensitive data and maintain customer trust. The urgency to address these threats is driving innovation and adoption within the software defined-security market, as companies look for scalable and flexible security frameworks to mitigate risks.

Growing Awareness of Data Privacy

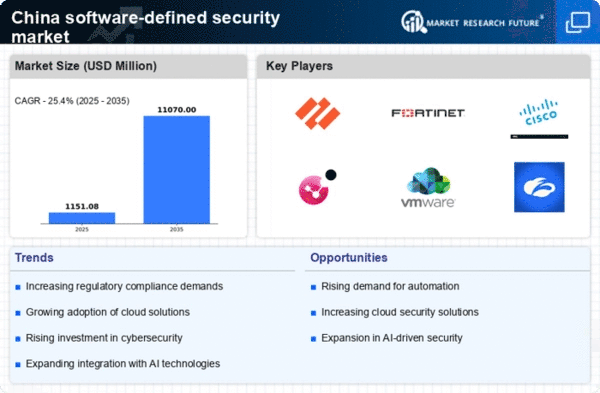

The rising awareness of data privacy among consumers and businesses is influencing the software defined-security market in China. With increasing concerns over data breaches and regulatory compliance, organizations are compelled to adopt security measures that ensure the protection of personal information. In 2025, it is projected that the data protection market in China will grow by 25%, reflecting the heightened focus on privacy. This awareness is driving companies to implement software defined-security solutions that not only safeguard data but also enhance their reputation in the marketplace. As a result, the software defined-security market is likely to expand as businesses seek to align with consumer expectations and regulatory requirements.

Government Initiatives and Support

The Chinese government is actively promoting the development of the software defined-security market through various initiatives and policies. In recent years, the government has launched programs aimed at enhancing national cybersecurity infrastructure, which includes funding for research and development in security technologies. This support is likely to foster collaboration between public and private sectors, leading to the creation of innovative security solutions. Furthermore, the government's emphasis on cybersecurity as a critical component of national security is expected to drive investments in software defined-security solutions. By 2025, it is projected that government spending on cybersecurity in China could reach $30 billion, significantly impacting the software defined-security market.

Digital Transformation of Enterprises

As Chinese enterprises undergo digital transformation, the software defined-security market is poised for substantial growth. The shift towards digital operations necessitates robust security measures to protect against emerging threats. In 2025, it is anticipated that over 70% of organizations in China will have adopted cloud-based services, increasing the need for integrated security solutions. This transformation is compelling businesses to rethink their security strategies, leading to a greater reliance on software defined-security technologies. The convergence of IT and operational technology is also creating new vulnerabilities, further driving the demand for comprehensive security frameworks that can adapt to evolving business needs.

Increased Investment in IT Infrastructure

The software defined-security market in China is benefiting from increased investments in IT infrastructure. As companies modernize their IT environments, there is a growing recognition of the need for advanced security solutions that can protect these infrastructures. In 2025, it is expected that IT spending in China will exceed $200 billion, with a significant portion allocated to security technologies. This investment trend suggests that organizations are prioritizing cybersecurity as a fundamental aspect of their IT strategy. Consequently, the software defined-security market is likely to see a surge in demand for solutions that offer flexibility, scalability, and enhanced protection against cyber threats.