Growing E-commerce Platforms

The expansion of e-commerce platforms in China is playing a pivotal role in the growth of the Smart Hardware Odm Market. With the rise of online shopping, consumers are increasingly purchasing smart devices through digital channels. Data indicates that e-commerce sales in China are expected to surpass 2 trillion USD by 2026, creating a substantial market for ODM manufacturers. This shift towards online retail not only broadens the reach of ODM products but also encourages manufacturers to enhance their marketing strategies and product visibility. Consequently, the synergy between e-commerce and ODM services is likely to drive further growth in the smart hardware sector.

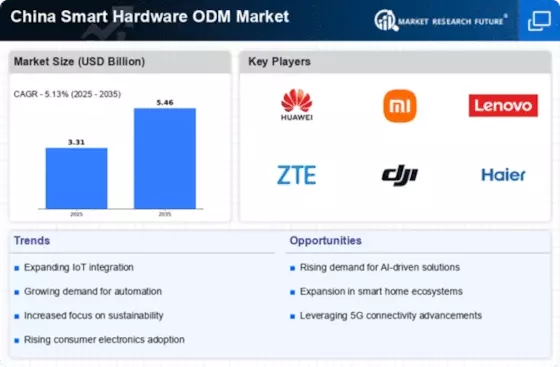

Increased Focus on Sustainability

Sustainability is becoming a critical focus within the China Smart Hardware Odm Market. As environmental concerns gain prominence, consumers are increasingly favoring eco-friendly products. ODM manufacturers are responding by adopting sustainable practices in their production processes, such as utilizing recyclable materials and reducing energy consumption. This shift towards sustainability is not only aligned with global trends but also resonates with the Chinese government's commitment to achieving carbon neutrality by 2060. By prioritizing sustainability, ODM companies can enhance their brand reputation and appeal to environmentally conscious consumers, thereby positioning themselves favorably in the competitive smart hardware market.

Government Initiatives and Policies

The Chinese government is actively promoting the development of the smart hardware sector through various initiatives and policies. The 'Made in China 2025' strategy emphasizes innovation and aims to transform China into a global leader in advanced manufacturing, including the Smart Hardware Odm Market. This governmental support is manifested in funding programs, tax incentives, and research grants aimed at fostering innovation among ODM manufacturers. Such initiatives are likely to enhance the competitiveness of Chinese ODM firms on a global scale, encouraging them to invest in research and development, which is crucial for sustaining growth in the smart hardware market.

Advancements in Manufacturing Technology

Technological advancements in manufacturing processes are significantly influencing the China Smart Hardware Odm Market. The integration of automation, robotics, and advanced manufacturing techniques is enhancing production efficiency and reducing costs for ODM providers. For instance, the implementation of Industry 4.0 principles is enabling manufacturers to optimize their operations, leading to faster turnaround times and improved product quality. This technological evolution not only supports the scalability of ODM businesses but also aligns with the increasing expectations of consumers for high-quality smart hardware. As a result, ODM companies are better positioned to meet the demands of the rapidly evolving market landscape.

Rising Consumer Demand for Smart Devices

The China Smart Hardware Odm Market is experiencing a notable surge in consumer demand for smart devices. As urbanization continues to rise, more consumers are seeking innovative solutions that enhance convenience and efficiency in their daily lives. According to recent data, the smart home device market in China is projected to reach approximately 100 billion USD by 2026. This growing appetite for smart technology is driving ODM manufacturers to innovate and expand their product offerings, thereby contributing to the overall growth of the industry. Furthermore, the increasing penetration of smartphones and the internet is facilitating the adoption of smart devices, which in turn propels the demand for ODM services in the market.