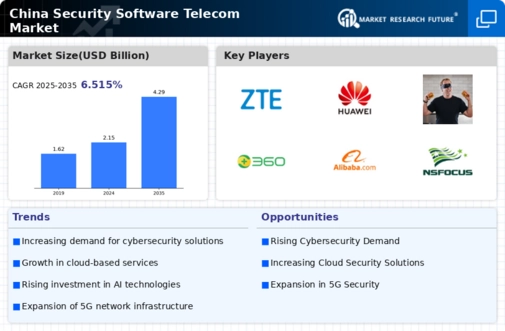

Rise of Cyber Threats and Attacks

The proliferation of cyber threats and attacks has emerged as a critical driver for the China security software telecom market. With the increasing sophistication of cybercriminals, organizations are compelled to adopt advanced security measures to protect their networks and data. In 2025, reports indicated a 30 percent increase in cyber incidents targeting telecom companies in China, underscoring the urgent need for effective security solutions. This alarming trend has prompted businesses to invest heavily in security software, leading to a projected market growth of 10 billion USD by 2026. As the threat landscape continues to evolve, the demand for innovative security solutions is expected to rise, further propelling the growth of the industry.

Government Initiatives and Support

The Chinese government plays a pivotal role in shaping the landscape of the security software telecom market through various initiatives and support mechanisms. Policies aimed at enhancing national cybersecurity have been introduced, including the Cybersecurity Law, which mandates that telecom operators implement stringent security measures. This regulatory framework not only fosters a secure environment but also encourages investment in security software solutions. In 2025, government funding for cybersecurity initiatives reached approximately 5 billion USD, indicating a strong commitment to bolstering the industry. Such support is likely to stimulate innovation and growth within the security software sector, as companies align their offerings with government standards and requirements.

Growing Demand for Data Protection

The increasing reliance on digital platforms in the China security software telecom market has led to a heightened demand for robust data protection solutions. As businesses and consumers alike become more aware of the risks associated with data breaches, the need for effective security software has surged. In 2025, the market for data protection solutions in China was valued at approximately 15 billion USD, reflecting a compound annual growth rate of 12 percent. This trend is likely to continue as organizations prioritize safeguarding sensitive information, thereby driving growth in the security software sector. Furthermore, the Chinese government has implemented stringent data protection regulations, compelling companies to invest in advanced security measures to comply with legal requirements.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into security software solutions is transforming the China security software telecom market. AI technologies enhance the ability to detect and respond to threats in real-time, thereby improving overall security posture. In 2025, the market for AI-driven security solutions in China was estimated at 8 billion USD, with a projected growth rate of 15 percent annually. This trend indicates a strong shift towards leveraging AI capabilities to combat cyber threats more effectively. As organizations increasingly adopt AI technologies, the demand for sophisticated security software is likely to escalate, driving further innovation and competition within the industry.

Expansion of Cloud-Based Security Solutions

The shift towards cloud-based security solutions is significantly influencing the China security software telecom market. As businesses migrate to cloud environments, the need for scalable and flexible security solutions has become paramount. In 2025, the market for cloud security software in China was valued at approximately 12 billion USD, reflecting a growing preference for cloud-based services. This trend is expected to continue as organizations seek to enhance their security frameworks while benefiting from the cost-effectiveness of cloud solutions. The increasing adoption of cloud technologies is likely to drive demand for innovative security software, thereby contributing to the overall growth of the industry.