Adoption of Cloud-Based Solutions

The shift towards cloud computing is significantly influencing the runtime application-self-protection market in China. As organizations migrate their operations to the cloud, the need for integrated security solutions becomes increasingly critical. By 2025, it is estimated that over 70% of enterprises in China will utilize cloud services, necessitating advanced runtime application self-protection measures. This transition not only enhances operational efficiency but also introduces new vulnerabilities that must be addressed. The runtime application-self-protection market is likely to see a surge in demand for solutions that can seamlessly integrate with cloud environments, ensuring that applications remain secure throughout their lifecycle. This trend underscores the importance of proactive security measures in a rapidly evolving technological landscape.

Growing Focus on Digital Transformation

Digital transformation initiatives are reshaping the business landscape in China, thereby impacting the runtime application-self-protection market. As companies embrace digital technologies to enhance operational efficiency and customer engagement, the security of applications becomes a critical concern. In 2025, it is anticipated that investments in digital transformation will exceed $200 billion, with a significant portion allocated to security solutions. The runtime application-self-protection market is poised to capitalize on this trend, as organizations seek to implement comprehensive security frameworks that protect their applications from emerging threats. This focus on digital transformation not only drives demand for runtime application self-protection solutions but also encourages innovation within the industry.

Rising Awareness of Cybersecurity Risks

The increasing awareness of cybersecurity risks among businesses in China is a key driver for the runtime application-self-protection market. As high-profile cyber incidents continue to make headlines, organizations are becoming more vigilant about protecting their digital assets. In 2025, it is projected that cybersecurity spending in China will reach $30 billion, reflecting a growing commitment to safeguarding applications. The runtime application-self-protection market is likely to benefit from this heightened awareness, as companies prioritize investments in security technologies that can mitigate risks. This trend indicates a shift towards a more proactive approach to cybersecurity, where runtime application self-protection solutions play a vital role in defending against potential threats.

Regulatory Pressures and Compliance Requirements

Regulatory pressures are increasingly shaping the runtime application-self-protection market in China. With the introduction of stringent data protection laws, organizations are compelled to adopt security measures that ensure compliance. By 2025, it is expected that compliance-related spending will account for a significant portion of the overall cybersecurity budget, driving demand for runtime application self-protection solutions. The runtime application-self-protection market must adapt to these evolving regulations, as businesses seek to implement technologies that not only protect their applications but also meet legal requirements. This dynamic creates opportunities for innovation and growth within the industry, as companies strive to navigate the complex regulatory landscape.

Increased Demand for Application Security Solutions

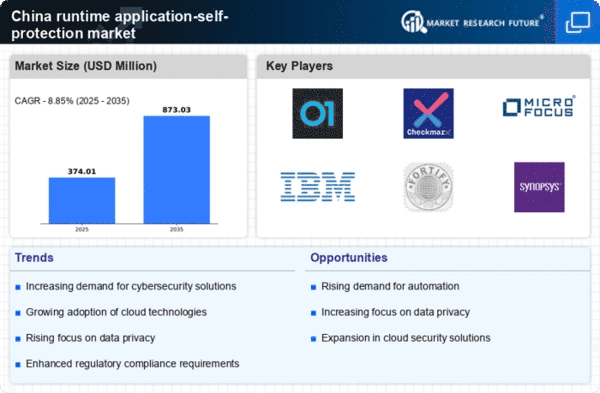

The runtime application-self-protection market in China is experiencing heightened demand for robust application security solutions. As businesses increasingly rely on digital platforms, the need to safeguard applications from potential threats has become paramount. In 2025, the market is projected to grow at a CAGR of 15%, driven by the rising awareness of cybersecurity risks. Organizations are investing in runtime application self-protection technologies to ensure that their applications are resilient against attacks. This trend is particularly evident in sectors such as finance and e-commerce, where sensitive data is frequently processed. The runtime application-self-protection market is thus positioned to benefit from this growing emphasis on security, as companies seek to protect their assets and maintain customer trust.