Market Trends

Key Emerging Trends in the China Recycled Polypropylene Market

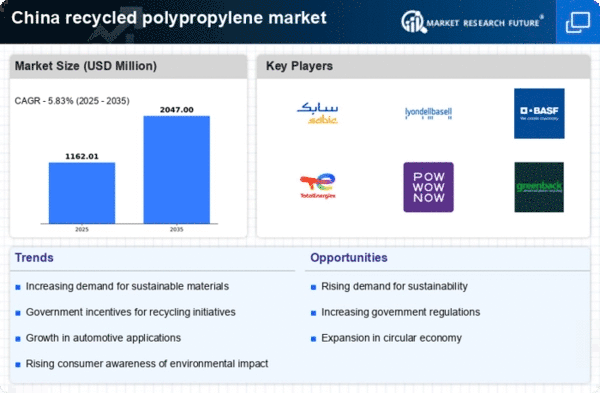

In China's recycled polypropylene (rPP) market, natural consciousness, roundabout economy pushes, and the growing demand for manageable bundling materials are driving key trends. Reusing polypropylene, a flexible polymer used in packaging, products, and cars, is a major trend in this sector. China's commitment to environmental sustainability has spurred polypropylene reuse as a way to reduce plastic waste and promote a circular economy.

Manageability and circular economy norms are driving China's vehicle industry to adopt recycled polypropylene. Auto interior trims, guards, and boards are made from recycled polypropylene. Recycled materials in the car industry support the industry's goal of reducing automobiles' natural appearance and promoting cost-effective assembly.

Mechanical advances in recycling processes are shaping the China Recycled Polypropylene Market, focusing on quality and cleanliness. High-level organizing, dissolving filtration, and decontamination methods are enhancing polypropylene recycling, making more recovered materials suitable for more applications. This pattern helps the market refine and automate reuse practices.

In China's recycled polypropylene market, supply chain partners are working together to create a closed-loop system. Together, recyclers, manufacturers, and end-users reconcile recycled polypropylene into different enterprises. These organizations help build a sustainable recycled polypropylene supply chain.

Buyer awareness and preference for affordable products affect the China Recycled Polypropylene Market. As purchasers become more environmentally conscious, recycled polypropylene products are in demand. In item packaging, Chinese companies and retailers are answering buyer preconceptions by using recycled polypropylene.

The China Recycled Polypropylene Market is driven by round economy norms that emphasize asset efficiency and waste reduction. The circular economy concept promotes material reuse to extend their lives and reduce environmental impact. By offering a cheaper alternative to plastics, recycled polypropylene helps achieve round economy goals.

China is using more recycled polypropylene in consumer and family items. To reduce their environmental impact, furniture and home appliances are using recycled polypropylene. This tendency reflects the larger shift toward fair and indirect procedures in manufacturing and customer items.

Leave a Comment