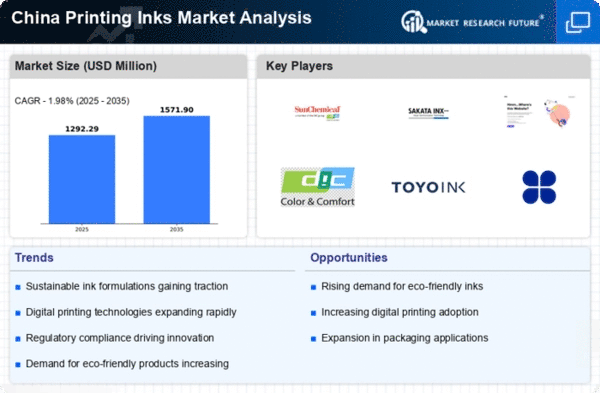

The printing inks market in China is characterized by a dynamic competitive landscape, driven by innovation, sustainability, and digital transformation. Major players such as Sun Chemical (US), DIC Corporation (JP), and Toyo Ink SC Holdings Co., Ltd. (JP) are actively shaping the market through strategic initiatives. Sun Chemical (US) focuses on expanding its product portfolio with eco-friendly inks, while DIC Corporation (JP) emphasizes technological advancements in ink formulation. Toyo Ink SC Holdings Co., Ltd. (JP) is enhancing its operational efficiency through digital solutions, collectively fostering a competitive environment that prioritizes sustainability and innovation.Key business tactics employed by these companies include localizing manufacturing and optimizing supply chains to enhance responsiveness to market demands. The market structure appears moderately fragmented, with several key players exerting influence over various segments. This fragmentation allows for niche players to thrive, while larger corporations leverage their resources to maintain competitive advantages through economies of scale and advanced technology.

In September Sun Chemical (US) announced the launch of a new line of bio-based inks aimed at reducing environmental impact. This strategic move not only aligns with global sustainability trends but also positions the company as a leader in eco-friendly solutions, potentially attracting environmentally conscious customers and enhancing brand loyalty.

In October DIC Corporation (JP) unveiled a partnership with a leading technology firm to develop AI-driven ink formulation processes. This collaboration is likely to streamline production and improve product quality, reflecting a broader trend towards automation and smart manufacturing in the industry. Such advancements may provide DIC with a competitive edge in terms of efficiency and innovation.

In August Toyo Ink SC Holdings Co., Ltd. (JP) expanded its operations in China by establishing a new manufacturing facility focused on digital inks. This expansion not only signifies the company's commitment to meeting the growing demand for digital printing solutions but also enhances its market presence in a rapidly evolving segment. The strategic importance of this move lies in its potential to capture a larger share of the digital printing market, which is expected to grow significantly in the coming years.

As of November current competitive trends in the printing inks market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances among key players are shaping the landscape, fostering innovation and enhancing supply chain reliability. The shift from price-based competition to a focus on technological advancement and sustainable practices is evident, suggesting that future competitive differentiation will hinge on the ability to innovate and adapt to changing market dynamics.