Aging Population

China's aging population is a significant factor influencing the positron emission-tomography-devices market. With a demographic shift towards an older population, the demand for advanced diagnostic tools is expected to rise. By 2025, it is estimated that over 300 million individuals in China will be aged 60 and above, leading to an increased prevalence of chronic diseases such as cancer and cardiovascular conditions. This demographic trend necessitates the use of sophisticated imaging technologies, including positron emission tomography, for accurate diagnosis and treatment planning. The healthcare system is likely to adapt to these changing needs by investing in advanced diagnostic equipment, thereby driving the positron emission-tomography-devices market. The correlation between an aging population and the demand for enhanced diagnostic capabilities suggests a robust growth trajectory for the market in the coming years.

Rising Incidence of Cancer

The increasing incidence of cancer in China serves as a crucial driver for the positron emission-tomography-devices market. Recent statistics indicate that cancer cases in China have surged, with estimates suggesting that over 4.5 million new cases are diagnosed annually. This alarming trend underscores the necessity for effective diagnostic tools, as early detection is vital for improving patient outcomes. Positron emission tomography devices play a critical role in cancer diagnosis and staging, allowing for precise imaging of metabolic activity in tumors. As healthcare providers strive to enhance cancer care, the demand for advanced imaging technologies is likely to escalate, thereby propelling the positron emission-tomography-devices market. The focus on oncology and the need for innovative diagnostic solutions indicate a promising outlook for market growth in the context of rising cancer incidence.

Increasing Healthcare Expenditure

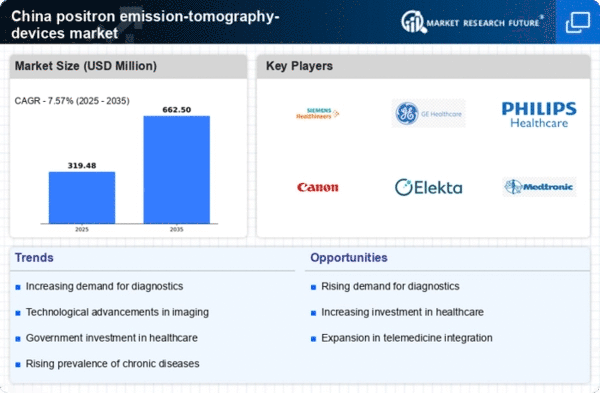

The rising healthcare expenditure in China is a pivotal driver for the positron emission-tomography-devices market. As the government allocates more funds towards healthcare, hospitals and diagnostic centers are increasingly investing in advanced imaging technologies. In 2025, healthcare spending in China is projected to reach approximately $1 trillion, reflecting a growth rate of around 10% annually. This financial commitment enables healthcare facilities to upgrade their equipment, including positron emission tomography devices, thereby enhancing diagnostic capabilities. The emphasis on improving healthcare infrastructure and access to advanced medical technologies is likely to stimulate demand for these devices, ultimately contributing to the growth of the positron emission-tomography-devices market. Furthermore, the focus on preventive healthcare and early diagnosis aligns with the increasing expenditure, creating a favorable environment for market expansion.

Technological Innovations in Imaging

Technological innovations in imaging modalities are significantly impacting the positron emission-tomography-devices market. Advances in detector technology, image reconstruction algorithms, and hybrid imaging systems are enhancing the performance and efficiency of positron emission tomography devices. These innovations not only improve image quality but also reduce scan times, making the technology more accessible to healthcare providers. In 2025, the introduction of new features such as artificial intelligence integration and enhanced software capabilities is expected to further drive market growth. As hospitals and diagnostic centers seek to adopt the latest technologies to improve patient care, the positron emission-tomography-devices market is likely to benefit from these advancements. The continuous evolution of imaging technology suggests a dynamic and competitive landscape for the market.

Growing Awareness of Diagnostic Imaging

The growing awareness of diagnostic imaging among healthcare professionals and patients is a notable driver for the positron emission-tomography-devices market. Increased education and outreach efforts have led to a better understanding of the benefits of advanced imaging techniques, including positron emission tomography. As healthcare providers recognize the importance of accurate and timely diagnosis, the demand for these devices is expected to rise. Furthermore, patient awareness campaigns highlighting the advantages of early detection and treatment are likely to contribute to market growth. In 2025, the emphasis on patient-centered care and the role of imaging in disease management will likely enhance the adoption of positron emission tomography devices. This heightened awareness within the healthcare community and among patients indicates a positive trajectory for the market.