Increased Awareness and Education

There is a growing awareness and education regarding the benefits of molecular diagnostics among healthcare professionals and patients in China. This heightened understanding is driving demand for point-of-care testing solutions, as stakeholders recognize the advantages of rapid and accurate diagnostics. Educational campaigns and training programs are being implemented to inform healthcare providers about the latest advancements in molecular diagnostics. As a result, the point-of-care molecular diagnostics market is witnessing an uptick in adoption rates, with estimates suggesting a growth of approximately 10% in the coming years. This trend underscores the importance of knowledge dissemination in fostering a more informed healthcare environment.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in China significantly influence the point of-care-molecular-diagnostics market. The Chinese government has been actively investing in healthcare reforms, which include funding for advanced diagnostic technologies. This support is evident in various national health programs that prioritize the development and deployment of point-of-care testing solutions. For instance, the government allocated approximately $1 billion in 2025 to enhance diagnostic capabilities across the country. Such financial backing not only fosters innovation but also encourages local manufacturers to develop cost-effective solutions, thereby expanding the market reach of point-of-care-molecular-diagnostics.

Rising Demand for Rapid Diagnostics

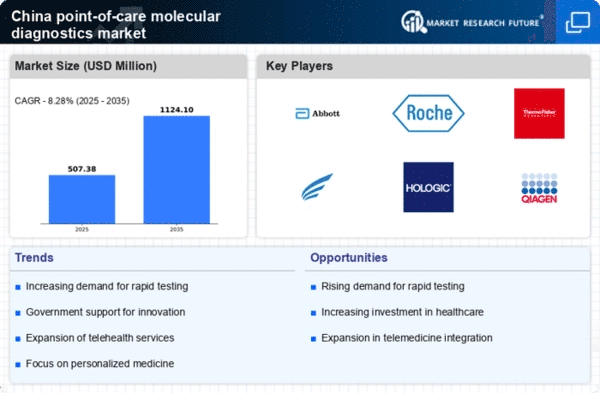

The increasing need for rapid diagnostic solutions in China is a key driver for the point of-care-molecular-diagnostics market. With a growing population and rising incidences of infectious diseases, healthcare providers are seeking efficient testing methods that can deliver results quickly. The demand for immediate diagnosis is particularly pronounced in rural and underserved areas, where access to traditional laboratory facilities is limited. This trend is reflected in the market, which is projected to grow at a CAGR of approximately 15% over the next five years. The ability to provide timely and accurate results not only enhances patient care but also reduces the burden on healthcare systems, thereby driving the expansion of the point of-care-molecular-diagnostics market in China.

Growing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases in China serves as a significant driver for the point of-care-molecular-diagnostics market. Conditions such as diabetes, cardiovascular diseases, and respiratory disorders are becoming increasingly common, necessitating regular monitoring and timely interventions. The ability to conduct molecular diagnostics at the point of care allows for more effective management of these diseases, as patients can receive immediate feedback on their health status. This trend is expected to contribute to a market growth rate of around 12% annually, as healthcare providers seek to integrate point-of-care solutions into routine care practices to enhance patient outcomes.

Technological Integration in Healthcare

The integration of advanced technologies such as artificial intelligence (AI) and machine learning into healthcare systems is transforming the point of-care-molecular-diagnostics market. In China, the adoption of these technologies is facilitating the development of more sophisticated diagnostic tools that can analyze data in real-time. This technological evolution not only improves the accuracy of tests but also streamlines workflows in clinical settings. As hospitals and clinics increasingly adopt these innovations, the market is likely to experience accelerated growth, with projections indicating a potential increase in market size by 20% over the next few years. The synergy between technology and diagnostics is reshaping the landscape of healthcare delivery.