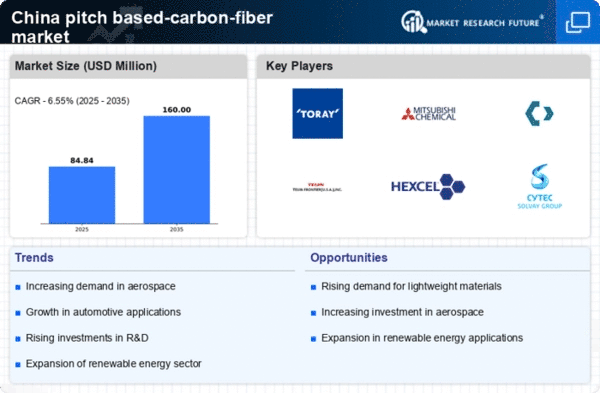

The pitch based-carbon-fiber market in China is characterized by a dynamic competitive landscape, driven by increasing demand across various sectors such as aerospace, automotive, and renewable energy. Key players are actively pursuing strategies that emphasize innovation, regional expansion, and strategic partnerships to enhance their market positioning. Companies like Toray Industries (Japan) and Mitsubishi Chemical Corporation (Japan) are focusing on technological advancements and sustainability initiatives, which appear to be pivotal in shaping the competitive environment. Their commitment to research and development, alongside efforts to optimize production processes, suggests a collective drive towards enhancing product performance and reducing environmental impact.In terms of business tactics, localizing manufacturing and optimizing supply chains are becoming increasingly critical. The market structure is moderately fragmented, with several key players exerting influence over pricing and product availability. This fragmentation allows for niche players to emerge, yet the presence of established companies like SGL Carbon (Germany) and Teijin Limited (Japan) ensures that competition remains robust. These companies are leveraging their global networks to streamline operations and enhance customer engagement, which may lead to improved market share.

In October SGL Carbon (Germany) announced a strategic partnership with a leading Chinese aerospace manufacturer to develop advanced pitch based-carbon-fiber composites for aircraft applications. This collaboration is likely to enhance SGL's technological capabilities while providing the aerospace manufacturer with access to high-performance materials, thereby reinforcing their competitive edge in the rapidly evolving aerospace sector. Such partnerships indicate a trend towards co-development, which could accelerate innovation cycles in the market.

In September Teijin Limited (Japan) launched a new line of pitch based-carbon-fiber products specifically designed for the automotive industry, focusing on lightweight and high-strength applications. This move appears to align with the growing demand for fuel-efficient vehicles, suggesting that Teijin is strategically positioning itself to capture a larger share of the automotive market. The introduction of these products may not only enhance Teijin's product portfolio but also contribute to the overall sustainability goals of the automotive sector.

In August Mitsubishi Chemical Corporation (Japan) expanded its production capacity for pitch based-carbon-fiber in China, reflecting a strong commitment to meeting the increasing demand from various industries. This expansion is indicative of Mitsubishi's strategy to solidify its market presence and enhance supply chain reliability. By increasing production capabilities, the company is likely to improve its responsiveness to market fluctuations and customer needs, which could be a decisive factor in maintaining competitiveness.

As of November current trends in the pitch based-carbon-fiber market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are shaping the landscape, fostering innovation and collaboration among key players. The competitive differentiation is expected to evolve, moving away from traditional price-based competition towards a focus on technological advancements, product innovation, and supply chain resilience. This shift may ultimately redefine how companies compete, emphasizing the importance of reliability and sustainability in their offerings.