Government Initiatives and Regulations

Government initiatives and regulations play a crucial role in shaping the pharmacy market in China. The Chinese government has implemented various policies aimed at improving healthcare access and affordability. For instance, the National Healthcare Security Administration has been working to expand the list of reimbursable medications, which is expected to enhance the pharmacy market's growth. Additionally, regulatory reforms are being introduced to streamline the approval process for new drugs, thereby encouraging innovation within the sector. These initiatives are likely to foster a more competitive environment, as pharmacies strive to comply with regulations while also meeting consumer needs. As a result, the pharmacy market is anticipated to benefit from increased investment and development, ultimately leading to improved healthcare outcomes for the population.

Increased Focus on Preventive Healthcare

There is a growing emphasis on preventive healthcare within the pharmacy market in China. This shift is largely driven by rising healthcare costs and a greater awareness of the importance of maintaining health rather than merely treating illness. Pharmacies are increasingly offering preventive services, such as health screenings and vaccination programs, to meet this demand. Recent data suggests that the preventive healthcare market is expected to grow at a CAGR of 10% over the next few years. This trend not only enhances the role of pharmacies as healthcare providers but also encourages consumers to take a proactive approach to their health. As pharmacies expand their services to include preventive care, the pharmacy market is likely to experience a transformation, positioning itself as a vital component of the broader healthcare system.

Expansion of E-commerce in Pharmaceuticals

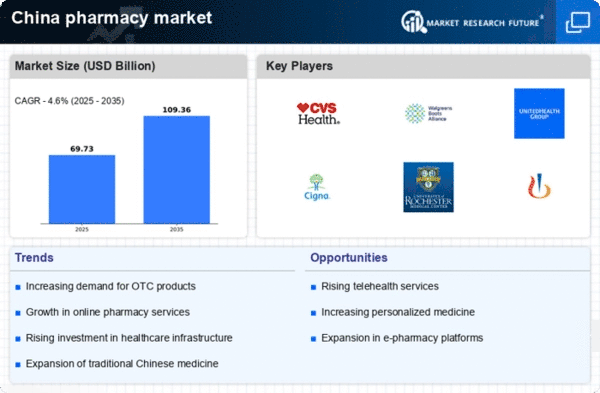

The rapid expansion of e-commerce platforms is significantly impacting the pharmacy market in China. With the rise of online shopping, consumers are increasingly turning to digital channels for purchasing medications and health products. Recent statistics indicate that online pharmaceutical sales are expected to account for over 30% of total sales by 2025. This shift is driven by the convenience of home delivery and the ability to compare prices easily. Consequently, traditional pharmacies are adapting by enhancing their online presence and integrating digital solutions into their operations. This transformation not only broadens the reach of pharmacies but also improves customer engagement. As e-commerce continues to evolve, it is likely to reshape the competitive landscape of the pharmacy market, compelling businesses to innovate and invest in technology to meet changing consumer preferences.

Rising Demand for Prescription Medications

The pharmacy market in China is experiencing a notable increase in the demand for prescription medications. This trend is driven by an aging population and a growing prevalence of chronic diseases, such as diabetes and hypertension. According to recent data, the market for prescription drugs is projected to reach approximately $150 billion by 2025, reflecting a compound annual growth rate (CAGR) of around 8%. This rising demand is compelling pharmacies to expand their offerings and improve service delivery. As a result, the pharmacy market is likely to see enhanced competition among providers, leading to better pricing and availability of essential medications. Furthermore, the increasing awareness of health issues among the population is contributing to this growth, as more individuals seek medical advice and treatment, thereby bolstering the pharmacy market's overall performance.

Technological Advancements in Pharmacy Services

Technological advancements are significantly influencing the pharmacy market in China. Innovations such as telepharmacy, automated dispensing systems, and mobile health applications are transforming how pharmacies operate and interact with patients. These technologies enhance efficiency and improve patient care by providing timely access to medications and health information. For example, telepharmacy services allow patients in remote areas to consult with pharmacists and receive prescriptions without the need for physical visits. This is particularly beneficial in a country with vast geographical diversity. As these technologies become more integrated into pharmacy operations, they are likely to enhance the overall customer experience and drive growth in the pharmacy market. Furthermore, the adoption of data analytics can help pharmacies better understand consumer behavior, leading to more tailored services and offerings.