Increasing Disposable Income

The rise in disposable income among the Chinese middle class is a significant driver for the personal accident-health-insurance market. As economic growth continues, more individuals are able to allocate funds towards insurance products. In 2025, it is projected that the average disposable income in urban areas will increase by approximately 8%, leading to greater spending on personal safety and health coverage. This financial capability allows consumers to invest in comprehensive personal accident insurance, which provides peace of mind and financial security. The personal accident-health-insurance market is expected to thrive as more individuals recognize the value of protecting themselves and their families against potential accidents.

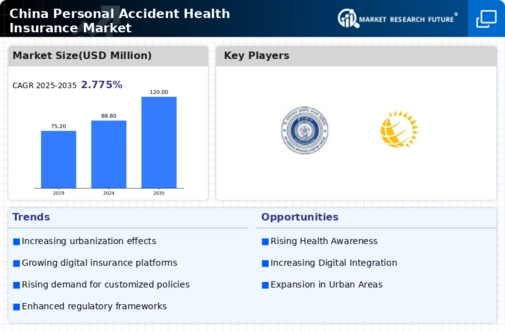

Rising Urbanization and Mobility

The rapid urbanization in China is a key driver for the personal accident-health-insurance market. As more individuals migrate to urban areas, the demand for personal accident coverage increases due to higher exposure to accidents in densely populated environments. In 2025, urbanization rates in China are projected to reach approximately 65%, leading to a significant rise in the number of vehicles and pedestrians. This urban mobility creates a greater risk of accidents, thereby necessitating comprehensive insurance solutions. The personal accident-health-insurance market is likely to see a surge in demand as urban residents seek protection against unforeseen incidents. Furthermore, the increasing number of commuters and the expansion of public transport systems contribute to the heightened need for personal accident coverage, making it a critical component of urban living.

Growing Awareness of Health Risks

There is an increasing awareness among the Chinese population regarding health risks associated with accidents, which serves as a substantial driver for the personal accident-health-insurance market. Educational campaigns and media coverage have highlighted the importance of having adequate insurance coverage to mitigate financial burdens resulting from accidents. In 2025, surveys indicate that approximately 70% of urban residents recognize the necessity of personal accident insurance, reflecting a shift in consumer attitudes towards proactive health management. This heightened awareness is likely to drive policy purchases, as individuals seek to safeguard their financial well-being. The personal accident-health-insurance market is expected to benefit from this trend, as more consumers prioritize insurance as a vital aspect of their overall health strategy.

Regulatory Changes and Compliance

Regulatory changes in China are influencing the personal accident-health-insurance market. The government is actively promoting insurance coverage as part of its broader health policy initiatives. In 2025, new regulations are anticipated to mandate minimum coverage levels for personal accident insurance, thereby increasing the overall market size. Compliance with these regulations will likely drive insurers to innovate and enhance their product offerings to meet consumer demands. This regulatory environment creates opportunities for growth within the personal accident-health-insurance market, as companies adapt to new standards and consumers benefit from improved coverage options. The emphasis on compliance may also lead to increased consumer trust in insurance providers.

Technological Advancements in Insurance

Technological advancements are transforming the personal accident-health-insurance market in China. The integration of digital platforms and mobile applications facilitates easier access to insurance products and services. In 2025, it is estimated that over 50% of insurance transactions will occur online, allowing consumers to compare policies and purchase coverage with greater convenience. Additionally, the use of data analytics enables insurers to better assess risks and tailor products to meet consumer needs. This technological evolution not only enhances customer experience but also streamlines claims processing, making it more efficient. As a result, the personal accident-health-insurance market is likely to expand, attracting tech-savvy consumers who prefer digital solutions for their insurance needs.