Increasing Aging Population

The aging population in China is a critical driver for the peripheral neuropathy market. As individuals age, the risk of developing neuropathic conditions escalates, primarily due to age-related diseases such as diabetes and hypertension. According to recent statistics, approximately 18% of the population in China is over 60 years old, a figure projected to rise significantly in the coming years. This demographic shift is likely to lead to a higher prevalence of peripheral neuropathy, thereby increasing the demand for treatment options. The peripheral neuropathy market must adapt to this growing need by developing targeted therapies and interventions that cater to the unique challenges faced by older adults. Furthermore, healthcare systems will need to allocate more resources to manage the rising cases of neuropathy, which could potentially reshape the market landscape.

Advancements in Diagnostic Techniques

Innovations in diagnostic techniques are transforming the peripheral neuropathy market. Enhanced imaging technologies and nerve conduction studies are enabling earlier and more accurate diagnoses of neuropathic conditions. In China, the integration of advanced diagnostic tools into clinical practice is expected to improve patient outcomes significantly. As healthcare providers become more adept at identifying peripheral neuropathy, the demand for specialized treatments is likely to increase. This shift may lead to a more competitive landscape within the peripheral neuropathy market, as companies strive to develop and market effective therapies. Furthermore, improved diagnostics can facilitate better patient management, potentially reducing the overall burden of neuropathy on the healthcare system.

Rising Prevalence of Chronic Diseases

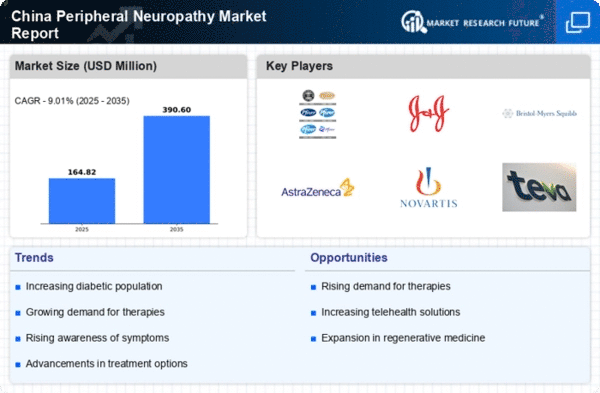

Chronic diseases, particularly diabetes and cardiovascular conditions, are on the rise in China, contributing to the growing peripheral neuropathy market. Data indicates that nearly 11% of the adult population is diagnosed with diabetes, a condition closely linked to neuropathy. As the prevalence of these chronic diseases increases, so does the incidence of peripheral neuropathy, which is often a complication of such conditions. The peripheral neuropathy market is likely to see a surge in demand for effective treatment options, including medications and rehabilitation therapies. Additionally, the healthcare sector may need to implement preventive measures and educational programs to address the underlying causes of these chronic diseases, thereby potentially reducing the incidence of neuropathy in the long term.

Rising Awareness of Neuropathy Symptoms

There is a growing awareness of the symptoms and implications of peripheral neuropathy among the Chinese population. Educational campaigns and outreach programs are helping to inform individuals about the signs of neuropathy, such as numbness, tingling, and pain in extremities. This heightened awareness is likely to lead to earlier diagnosis and treatment, which could significantly impact the peripheral neuropathy market. As more individuals seek medical attention for their symptoms, the demand for effective therapies and management strategies is expected to rise. The peripheral neuropathy market may need to adapt its marketing strategies to address this increasing awareness, ensuring that patients are informed about available treatment options and support services.

Growing Investment in Healthcare Infrastructure

China's commitment to enhancing its healthcare infrastructure is a pivotal driver for the peripheral neuropathy market. The government has been investing heavily in healthcare facilities and services, aiming to improve access to quality care for all citizens. This investment is likely to lead to better diagnosis and treatment options for patients suffering from peripheral neuropathy. As healthcare facilities expand and modernize, the peripheral neuropathy market may experience increased demand for innovative therapies and rehabilitation services. Moreover, the focus on healthcare infrastructure could foster collaborations between public and private sectors, potentially accelerating the development of new treatment modalities and improving patient outcomes.