Rising Healthcare Expenditure

Japan's healthcare expenditure has been on the rise, which positively impacts the peripheral neuropathy market. The government has been increasing its budget allocation for healthcare services, with spending projected to reach approximately $500 billion by 2026. This increase allows for better access to advanced treatments and medications for neuropathy. Furthermore, the introduction of new healthcare policies aims to enhance patient care and support innovative therapies. As healthcare spending continues to grow, the peripheral neuropathy market is likely to benefit from increased investment in research and development, leading to the introduction of novel treatment options and improved patient outcomes.

Increased Awareness and Education

There is a growing awareness regarding peripheral neuropathy in Japan, which serves as a significant driver for the market. Educational initiatives by healthcare professionals and organizations have led to improved recognition of symptoms and conditions associated with neuropathy. Surveys indicate that nearly 60% of the population is now more informed about the risks and management of neuropathic disorders. This heightened awareness encourages individuals to seek medical advice sooner, leading to earlier diagnosis and treatment. As a result, the peripheral neuropathy market is witnessing an uptick in demand for diagnostic tools and therapeutic options, as patients are more proactive in managing their health.

Advancements in Pharmaceutical Research

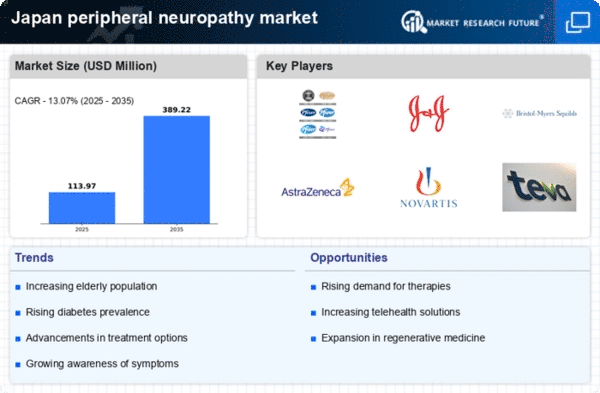

The pharmaceutical sector in Japan is experiencing rapid advancements, which significantly influences the peripheral neuropathy market. Research institutions and companies are focusing on developing new drugs and therapies that target neuropathic pain and its underlying causes. Recent studies have shown that innovative treatments, such as gene therapy and regenerative medicine, are showing promise in clinical trials. The potential for these advancements to revolutionize treatment options is substantial, as they may offer more effective solutions for patients. Consequently, the peripheral neuropathy market is poised for growth as these new therapies become available, addressing unmet medical needs and improving quality of life for patients.

Integration of Digital Health Solutions

The integration of digital health solutions into the healthcare system in Japan is emerging as a key driver for the peripheral neuropathy market. Telemedicine and mobile health applications are becoming increasingly popular, allowing patients to manage their conditions more effectively. Reports suggest that around 40% of patients with chronic conditions are utilizing digital tools for monitoring and treatment. This trend not only enhances patient engagement but also facilitates better communication between healthcare providers and patients. As digital health solutions continue to evolve, the peripheral neuropathy market is likely to see a shift towards more personalized and accessible care, ultimately improving treatment adherence and outcomes.

Aging Population and Neuropathy Prevalence

The aging population in Japan is a critical driver for the peripheral neuropathy market. As individuals age, the risk of developing neuropathic conditions increases significantly. Data indicates that approximately 30% of elderly individuals experience some form of neuropathy, which correlates with the rising number of older adults in Japan. This demographic shift is expected to continue, with projections suggesting that by 2030, over 30% of the population will be aged 65 and above. Consequently, the demand for effective treatments and management strategies for peripheral neuropathy is likely to escalate, thereby propelling the market forward. The peripheral neuropathy market must adapt to cater to this growing segment, focusing on tailored therapies and support systems for the elderly.