Adoption of Cloud-Based Analytics Solutions

The shift towards cloud computing is significantly influencing the performance analytics market in China. Organizations are increasingly adopting cloud-based analytics solutions due to their scalability, cost-effectiveness, and ease of access. This transition allows businesses to analyze large volumes of data in real-time, facilitating quicker decision-making processes. By 2025, it is anticipated that the market for cloud-based performance analytics tools will expand by around 20%, as more companies recognize the advantages of cloud technology. This trend not only enhances operational efficiency but also supports the growing need for remote work capabilities, further driving the performance analytics market.

Emergence of Advanced Analytical Techniques

The performance analytics market in China is witnessing the emergence of advanced analytical techniques, such as predictive and prescriptive analytics. These methodologies enable organizations to not only analyze historical data but also forecast future trends and prescribe actions based on insights. As businesses seek to stay ahead of the competition, the adoption of these advanced techniques is likely to increase. By 2025, the market could experience a growth rate of approximately 14%, as companies invest in sophisticated analytics tools to enhance their strategic planning and operational effectiveness. This evolution in analytical capabilities is reshaping the landscape of the performance analytics market.

Rising Demand for Data-Driven Decision Making

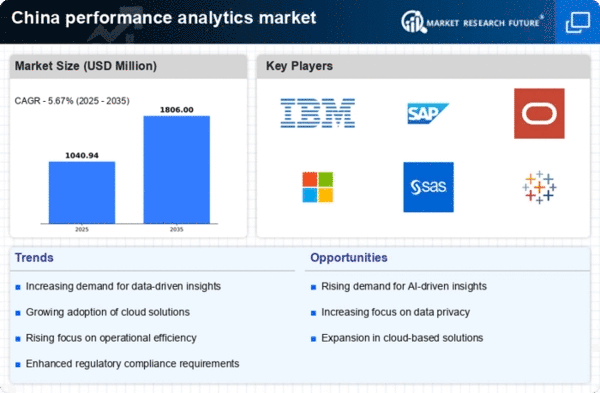

The performance analytics market in China is experiencing a notable surge in demand as organizations increasingly recognize the value of data-driven decision making. This trend is largely fueled by the need for businesses to enhance operational efficiency and improve customer experiences. In 2025, it is estimated that the market will grow by approximately 15%, driven by sectors such as finance, retail, and manufacturing. Companies are investing in performance analytics tools to gain insights into their operations, enabling them to make informed decisions that can lead to competitive advantages. As a result, the performance analytics market is essential for strategic planning and execution across various industries in China..

Increased Focus on Customer Experience Optimization

In the competitive landscape of China, businesses are placing a heightened emphasis on optimizing customer experiences, which is driving the performance analytics market. Companies are leveraging analytics to understand customer behavior, preferences, and feedback, allowing them to tailor their offerings accordingly. This trend is particularly evident in the e-commerce and retail sectors, where personalized marketing strategies are becoming the norm. As organizations strive to enhance customer satisfaction and loyalty, the performance analytics market is projected to grow by approximately 18% by 2025. This focus on customer-centric strategies underscores the importance of analytics in shaping business outcomes.

Government Initiatives Supporting Digital Transformation

The Chinese government is actively promoting digital transformation across various sectors, which significantly impacts the performance analytics market. Initiatives aimed at enhancing technological infrastructure and encouraging innovation are likely to create a conducive environment for the adoption of performance analytics solutions. For instance, the government's push for smart city projects and Industry 4.0 is expected to drive investments in analytics tools. By 2025, the performance analytics market could see an increase in funding and support from public sector initiatives, potentially leading to a market growth rate of around 12%. This governmental backing is crucial for fostering a culture of data utilization in decision-making processes.