Growing Aging Population

The shift towards an aging population in China is a critical factor influencing the percutaneous coronary-intervention market. With projections indicating that by 2030, over 300 million individuals will be aged 60 and above, the demand for cardiovascular interventions is expected to escalate. Older adults are more susceptible to heart diseases, necessitating effective treatment options. This demographic trend compels healthcare providers to enhance their cardiovascular care capabilities, thereby driving the growth of the percutaneous coronary-intervention market. Additionally, as awareness of heart health increases among the elderly, there is likely to be a greater willingness to seek out these interventions, further propelling market expansion.

Increasing Healthcare Expenditure

The rise in healthcare expenditure is a significant driver for the percutaneous coronary-intervention market in China. As the country continues to develop economically, healthcare spending has increased, with projections indicating a growth rate of approximately 7% annually. This increase allows for greater investment in advanced medical technologies and facilities, which are essential for performing percutaneous coronary interventions. Furthermore, as more patients gain access to health insurance, the demand for these procedures is expected to rise. The expansion of private healthcare facilities also contributes to this trend, as they often offer state-of-the-art services. Consequently, the percutaneous coronary-intervention market is likely to thrive in this environment of increasing financial support.

Advancements in Medical Technology

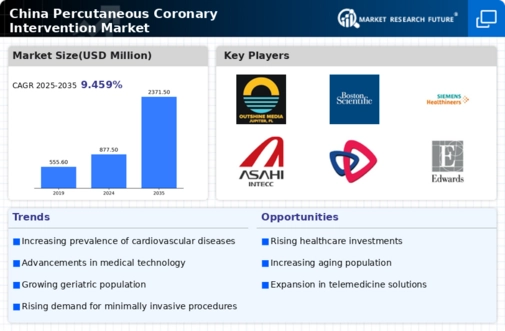

Technological innovations play a crucial role in shaping the percutaneous coronary-intervention market. The introduction of advanced imaging techniques, such as intravascular ultrasound and optical coherence tomography, enhances procedural accuracy and patient outcomes. Moreover, the development of new stent designs and materials has improved the efficacy of interventions, leading to lower complication rates. In China, the market for these advanced devices is projected to grow at a CAGR of around 10% over the next five years. This growth is driven by the increasing adoption of minimally invasive procedures, which are favored for their reduced recovery times and lower risk profiles. As hospitals and clinics invest in cutting-edge technologies, the percutaneous coronary-intervention market is likely to experience significant expansion.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure are pivotal for the percutaneous coronary-intervention market. In recent years, the Chinese government has implemented various policies to enhance cardiovascular care, including increased funding for hospitals and medical research. These initiatives are designed to improve access to advanced treatment options for patients suffering from heart diseases. For instance, the Healthy China 2030 initiative emphasizes the importance of cardiovascular health, which is expected to drive investments in medical technologies and training for healthcare professionals. As a result, the percutaneous coronary-intervention market is likely to benefit from enhanced resources and support, fostering an environment conducive to growth and innovation.

Rising Incidence of Cardiovascular Diseases

The increasing prevalence of cardiovascular diseases in China is a primary driver for the percutaneous coronary-intervention market. According to recent health statistics, cardiovascular diseases account for approximately 40% of all deaths in the country. This alarming trend necessitates effective treatment options, leading to a surge in demand for percutaneous coronary interventions. As healthcare providers seek to address this growing health crisis, the market is expected to expand significantly. The Chinese government has recognized this issue, allocating substantial resources to improve cardiovascular care, which further supports the market's growth. With an aging population and lifestyle changes contributing to higher disease rates, the percutaneous coronary-intervention market is poised for robust development in the coming years.