Rising Incidence of Orthopedic Disorders

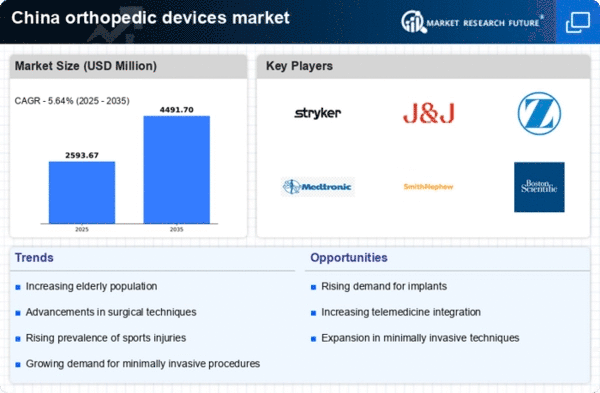

The increasing prevalence of orthopedic disorders in China is a primary driver for the orthopedic devices market. Conditions such as osteoarthritis, osteoporosis, and sports-related injuries are becoming more common, particularly among the aging population. According to recent estimates, approximately 30% of adults over 60 years old in China suffer from some form of arthritis. This growing patient demographic necessitates advanced orthopedic solutions, thereby propelling market growth. The orthopedic devices market is projected to witness a compound annual growth rate (CAGR) of around 8% over the next five years, driven by the demand for joint replacement and fixation devices. As healthcare providers focus on improving patient outcomes, the need for innovative orthopedic devices becomes increasingly critical.

Rising Sports Participation and Injuries

The surge in sports participation among the Chinese population is contributing to the growth of the orthopedic devices market. As more individuals engage in recreational and competitive sports, the incidence of sports-related injuries is on the rise. This trend is particularly evident among younger demographics, where injuries such as ligament tears and fractures are becoming more common. The orthopedic devices market is responding to this demand by offering a range of products, including braces, splints, and rehabilitation devices tailored for sports injuries. The market is projected to grow by approximately 7% annually, as athletes and active individuals seek effective solutions for injury prevention and recovery.

Growing Awareness of Preventive Healthcare

There is a notable shift towards preventive healthcare in China, which is influencing the orthopedic devices market. As the population becomes more health-conscious, there is an increasing emphasis on early diagnosis and preventive measures for orthopedic conditions. Educational campaigns and community health programs are raising awareness about the importance of maintaining musculoskeletal health. This trend is likely to drive demand for orthopedic devices that support preventive care, such as braces and supports. The orthopedic devices market may see a rise in sales of these products, as consumers seek to avoid injuries and manage existing conditions proactively. This growing awareness could potentially lead to a market expansion of around 5% annually.

Technological Innovations in Orthopedic Devices

Technological advancements are reshaping the orthopedic devices market in China. Innovations such as 3D printing, robotics, and smart implants are revolutionizing the design and functionality of orthopedic devices. For instance, 3D-printed implants offer customized solutions that enhance patient outcomes and reduce recovery times. The integration of robotics in surgical procedures is also improving precision and efficiency, which is crucial for complex orthopedic surgeries. As these technologies become more accessible, the orthopedic devices market is likely to experience accelerated growth. It is estimated that the market for technologically advanced orthopedic devices could expand by 10% over the next few years, driven by increased adoption in hospitals and clinics.

Government Initiatives and Healthcare Investments

Government initiatives aimed at enhancing healthcare infrastructure in China significantly impact the orthopedic devices market. The Chinese government has been investing heavily in healthcare reforms, with a focus on improving access to advanced medical technologies. In 2025, the healthcare expenditure is projected to reach approximately $1 trillion, with a substantial portion allocated to orthopedic care. These investments are likely to facilitate the adoption of cutting-edge orthopedic devices, including minimally invasive surgical tools and advanced imaging technologies. Furthermore, the government's commitment to increasing the availability of orthopedic services in rural areas may further stimulate market growth, as more patients gain access to necessary treatments.