Increased Focus on Cybersecurity

The rising threat of cyberattacks in China has led to an increased focus on cybersecurity within the network management market. Organizations are recognizing the importance of securing their networks against potential breaches, which has resulted in heightened investments in security-focused network management solutions. The market is responding to this demand by offering tools that integrate security features, such as threat detection and response capabilities. It is projected that the cybersecurity segment of the network management market will grow by 20% annually as businesses prioritize safeguarding their digital assets. This emphasis on security not only enhances the resilience of networks but also fosters trust among consumers and stakeholders.

Growth of IoT and Connected Devices

The proliferation of Internet of Things (IoT) devices in China is a key driver for the network management market. With millions of devices connected to networks, the complexity of managing these connections increases. Organizations are investing in network management solutions that can handle the scale and diversity of IoT devices. It is estimated that by 2025, the number of connected devices in China will exceed 1 billion. This surge necessitates robust network management tools that can ensure seamless connectivity and security. As businesses seek to harness the potential of IoT, the demand for effective network management solutions is likely to escalate, thereby propelling market growth.

Rising Demand for Network Efficiency

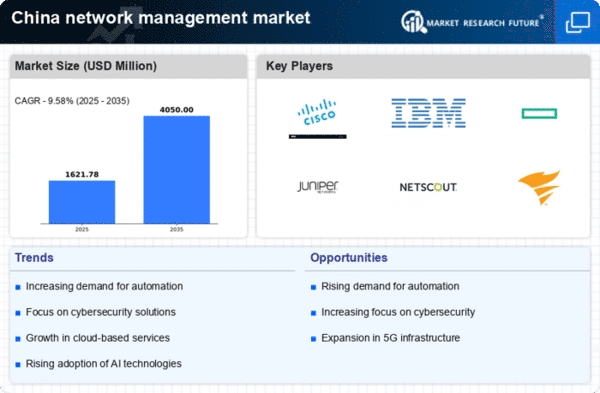

The increasing complexity of network infrastructures in China drives a rising demand for enhanced network efficiency. Organizations are seeking solutions that optimize performance and reduce latency, which is crucial for maintaining competitive advantage. The network management market is experiencing growth as businesses invest in tools that provide real-time monitoring and analytics. According to recent data, the market is projected to grow at a CAGR of 12% over the next five years. This trend indicates a strong focus on improving operational efficiency, which is essential for businesses aiming to leverage digital transformation. As companies expand their digital footprints, the need for effective network management solutions becomes paramount, thereby propelling the market forward.

Government Initiatives and Regulations

Government initiatives in China aimed at enhancing digital infrastructure are significantly impacting the network management market. Policies promoting smart cities and digital economy initiatives are encouraging investments in advanced network management solutions. The Chinese government has allocated substantial funding, estimated at $10 billion, to support the development of digital infrastructure. This funding is likely to stimulate demand for network management tools that ensure compliance with regulatory standards. As organizations adapt to these regulations, the network management market is expected to see increased adoption of solutions that facilitate compliance and enhance operational capabilities. The interplay between government support and market needs creates a conducive environment for growth.

Shift Towards Hybrid Network Environments

The transition to hybrid network environments is reshaping the landscape of the network management market in China. Organizations are increasingly adopting a mix of on-premises and cloud-based solutions to enhance flexibility and scalability. This shift necessitates advanced network management tools that can integrate and manage diverse environments effectively. As businesses seek to optimize their operations, the market is witnessing a surge in demand for solutions that provide visibility and control across hybrid networks. Analysts suggest that this trend could lead to a market growth rate of 15% over the next few years, as companies prioritize agility and responsiveness in their network management strategies.